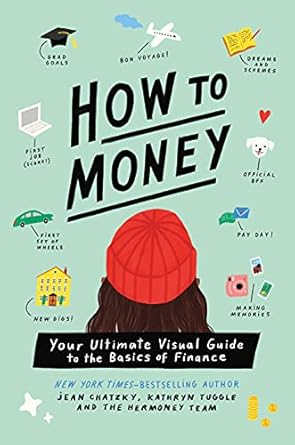

Discover the essential financial knowledge you need with *How to Money: Your Ultimate Visual Guide to the Basics of Finance*, a vibrant, illustrated guide designed especially for teens and Gen Z. Co-authored by New York Times bestselling author Jean Chatzky and financial expert Kathryn Tuggle, this book breaks down the complexities of money management in a fun and accessible way. Whether you’re navigating your first job, managing college loans, or learning the art of investing, this guide equips you with the tools to take control of your financial future.

Highlighted as a 2023 Business Insider Best Personal Finance Book and featured on *Live with Kelly and Ryan*, *How to Money* is more than just a book; it’s a roadmap for financial empowerment. Packed with exclusive interviews from industry leaders and practical tips, this book makes mastering money less daunting and more exciting. Perfect for gifting during the holidays, graduations, or back-to-school, it’s a must-have for anyone looking to be fearless with their finances!

How to Money: Your Ultimate Visual Guide to the Basics of Finance

Why This Book Stands Out?

- Engaging Visual Format: With its full-color illustrations, this guide makes learning about finance enjoyable and accessible, perfect for visual learners.

- Expert Insights: Authored by New York Times bestselling author Jean Chatzky and financial expert Kathryn Tuggle, offering credible knowledge and experience.

- Targeted for Teens and Gen Z: Specifically designed for younger audiences, it addresses their unique financial challenges and aspirations.

- Real-Life Interviews: Features exclusive insights from CEOs and activists, providing inspiration and practical advice straight from the experts.

- Comprehensive Content: Covers essential topics like budgeting, college loans, credit cards, and investing, equipping readers with the tools to manage money effectively.

- Recognized Excellence: A 2023 Business Insider Best Personal Finance Book, ensuring you’re reading a top-rated resource in personal finance.

- Gift-Worthy: An ideal present for holidays, graduations, and back-to-school, making financial literacy a thoughtful gift.

Personal Experience

As I flipped through the pages of How to Money: Your Ultimate Visual Guide to the Basics of Finance, I couldn’t help but reflect on my own journey with money management. It’s often said that we learn from our mistakes, but what if we had a resource that could guide us before we stumbled? This book feels like that guiding hand, offering insights that resonate deeply with anyone navigating the complexities of personal finance.

Remember those days in high school when we were more focused on finding the perfect prom outfit than understanding how to budget for college? I wish I had this book back then! It’s not just a manual; it’s an engaging roadmap filled with vibrant illustrations that make learning about finance feel less intimidating. Here are some key aspects that stood out to me:

- Creating a Budget: The step-by-step approach to budgeting made me realize how essential this skill is. I often found myself overwhelmed with expenses, and this book breaks it down into manageable pieces.

- First Job Insights: Remember your first paycheck? It’s such a big milestone, but also a confusing one. The book explains what that paycheck means and how to make the most of it, which is invaluable for anyone entering the workforce.

- College Loans: The chapters on navigating student debt are a lifesaver. I wish I had understood the implications of loans better before signing on the dotted line!

- Understanding Credit: Getting your first credit card can feel like a rite of passage, but this book demystifies credit and offers practical advice on how to use it wisely.

- Investing Basics: The section on investing is particularly eye-opening. It encourages readers to think about their financial future and offers simple strategies to get started, which is a game-changer for many.

Reading this book feels like a conversation with a wise friend who genuinely wants you to succeed. The stories, interviews, and practical tips all come together to create a relatable narrative that speaks directly to our experiences and aspirations. Whether you’re a teenager just starting out or someone looking to refresh your financial knowledge, How to Money is a resource that resonates on a personal level, making the journey toward financial literacy feel achievable and even exciting.

Who Should Read This Book?

If you’re a teenager, a young adult, or a parent looking to guide your child through the financial maze of life, then How to Money: Your Ultimate Visual Guide to the Basics of Finance is just what you need! This book is a fantastic resource designed specifically for those who are stepping into the world of personal finance for the first time.

Here’s why this book is perfect for you:

- Teens and Gen Z: If you’re in high school or college, this book breaks down complex financial concepts into easy-to-understand visuals and practical advice. It’s like having a financial mentor by your side to help you navigate your first paycheck, budgeting, and even student loans!

- Young Adults: Just starting your career? This guide will equip you with the knowledge to make informed decisions about credit cards, investing, and saving for your future. It’s a roadmap to financial independence!

- Parents: Looking for a way to teach your kids about money management? This book is a perfect tool to initiate important conversations about budgeting and financial responsibility in a relatable and engaging way.

- Anyone Feeling Overwhelmed by Finances: If the world of finance feels intimidating, this colorful, illustrated guide simplifies everything. You’ll not only learn how to manage money but also gain the confidence to make smart financial choices.

With exclusive insights from experts and real-life stories, How to Money empowers you to take charge of your finances and enjoy life without the stress of money worries. Grab a copy and start your journey towards financial literacy today!

How to Money: Your Ultimate Visual Guide to the Basics of Finance

Key Takeaways

If you’re looking to gain a solid understanding of personal finance, here are the most important insights you can expect from How to Money: Your Ultimate Visual Guide to the Basics of Finance:

- Budgeting Basics: Learn how to create a budget that works for you and strategies to stick to it, ensuring you’re in control of your finances.

- Employment Insights: Discover how to land your first job and understand what your paycheck really means, setting the foundation for your financial independence.

- Student Loans Navigation: Get essential tips on managing college loans and avoiding the pitfalls of student debt, helping you make informed decisions about your education financing.

- Understanding Credit: Gain clarity on credit cards and what “credit” really is, empowering you to use credit responsibly and effectively.

- Smart Investing: Learn the fundamentals of investing, why it’s crucial to your financial future, and how to start investing like a pro.

- Expert Insights: Benefit from exclusive HerMoney interviews with CEOs and activists, providing real-world perspectives and advice on financial topics.

- Empowerment Through Knowledge: Equip yourself with the tools to earn more, save smarter, invest wisely, and enjoy your financial journey without fear.

Final Thoughts

In a world where financial literacy is more important than ever, How to Money: Your Ultimate Visual Guide to the Basics of Finance stands out as an essential resource for teens and Gen Z. Authored by renowned financial expert Jean Chatzky and Kathryn Tuggle, this full-color illustrated guide simplifies complex financial concepts, making them accessible and engaging for young readers. Whether you’re navigating your first job, tackling student loans, or learning the art of budgeting, this book equips you with the knowledge and confidence to make smart financial decisions.

Key benefits of How to Money include:

- Clear explanations of budgeting and saving strategies.

- Insights on securing your first job and understanding paychecks.

- Guidance on managing college loans and avoiding debt traps.

- Fundamental lessons on credit and how to use it wisely.

- Introduction to investing and its significance in building wealth.

This book is not just a guide; it’s a companion for anyone looking to take charge of their financial future. Perfect as a gift for the holidays, graduations, or simply to empower yourself, How to Money is a worthwhile addition to any reader’s collection.

Don’t miss out on this opportunity to transform your understanding of money! Purchase your copy today!