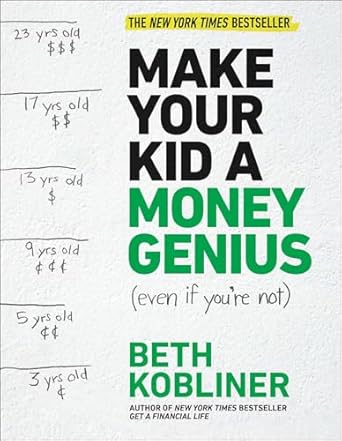

Unlock the secrets to financial success for your children with “Make Your Kid A Money Genius (Even If You’re Not)” by bestselling author Beth Kobliner. This essential guide is tailored for parents of kids aged 3 to 23, offering practical, jargon-free advice on teaching money management skills that last a lifetime. Discover how to instill foundational financial values like delayed gratification and generosity, ensuring your child grows into a financially savvy adult.

Research shows that money habits are formed as early as age seven, making it crucial for parents to engage in financial education early on. With this book, you’ll learn effective strategies to foster a healthy relationship with money, from understanding allowances to navigating credit cards. Regardless of your own financial expertise, this delightful and informative guide equips you to raise a money genius, empowering your kids to thrive not just financially, but in all aspects of life.

Make Your Kid A Money Genius (Even If You’re Not): A Parents’ Guide for Kids 3 to 23

Why This Book Stands Out?

- Research-Backed Insights: Leverages studies showing that children can grasp money concepts as young as three, emphasizing the importance of early financial education.

- Comprehensive Age Range: Offers guidance for teaching financial literacy to kids from ages three to twenty-three, making it suitable for all stages of childhood.

- Focus on Values Over Jargon: Prioritizes instilling essential life values—like delayed gratification and generosity—rather than complex financial terminology.

- Practical, Step-by-Step Approach: Provides a clear roadmap for parents, regardless of their financial expertise, to foster money management skills in their children.

- Challenging Common Myths: Debunks traditional beliefs about allowances and after-school jobs, encouraging parents to think differently about teaching money management.

- Engaging and Accessible: Written in a charming and relatable style, making it enjoyable for parents to read and apply the concepts with their kids.

- Proven Techniques: Shares effective strategies that have been shown to produce financially savvy and responsible adults.

Personal Experience

As parents, we often find ourselves navigating the complex world of finances alongside our children. The journey can be overwhelming, filled with uncertainties about the right lessons to impart and the best methods to use. Make Your Kid A Money Genius (Even If You’re Not) by Beth Kobliner offers a refreshing perspective that resonates deeply with many of us.

Many readers may find themselves reflecting on their own childhood experiences with money, recalling the lessons they learned—or didn’t learn—from their parents. This book encourages us to reconsider our approach and emphasize the importance of financial literacy from an early age. Here are some relatable insights that may resonate on a personal level:

- Understanding Early Habits: Remembering how our own money habits were shaped as children, we may realize that the lessons we teach our kids today can have lasting impacts.

- Overcoming Financial Anxiety: The book acknowledges that not every parent feels confident discussing money. Many readers might find comfort in Kobliner’s reassuring tone, which emphasizes that you don’t need to be a financial expert to teach your kids valuable lessons.

- Real-Life Applications: As you read through the practical advice, you might recall moments when you wished you had a better grasp of money management, prompting you to implement these strategies with your children.

- Creating Meaningful Conversations: The book encourages open dialogues about money, which can spark meaningful discussions in your family, making financial topics less taboo and more accessible.

- Setting Values Over Rules: You may find yourself reflecting on your own values regarding money and how they align with the principles outlined by Kobliner, fostering a more holistic approach to teaching your children.

Ultimately, Make Your Kid A Money Genius is not just a guide; it is a journey into understanding our own financial narratives and how we can shape a brighter financial future for our children. Whether you’re a seasoned financial planner or someone who feels lost in numbers, this book offers insights that can enhance your parenting experience and foster a financially savvy generation.

Who Should Read This Book?

This book is ideal for a wide range of parents and caregivers who want to equip their children with essential money management skills from an early age.

- Parents of Young Children: Those with kids aged 3 to 7 will find practical strategies to introduce basic financial concepts and instill good habits early on.

- Parents of Teens: For parents navigating the financial challenges of teenagers, the book provides valuable insights on managing allowances, jobs, and credit.

- New Parents: Expecting parents or those with newborns will benefit from understanding how to lay a strong financial foundation for their future children.

- Caregivers and Educators: Anyone involved in child-rearing or education can use the principles outlined to foster financial literacy among children and teens.

- Parents with Limited Financial Knowledge: Even if you’re not a finance expert, this book is written in an accessible manner, offering clear guidance for parents of all income levels.

By reading this book, these audiences will gain the tools to help their children develop lifelong financial skills and values, ultimately leading to better money management and financial success in adulthood.

Make Your Kid A Money Genius (Even If You’re Not): A Parents’ Guide for Kids 3 to 23

Key Takeaways

Make Your Kid a Money Genius (Even If You’re Not) offers valuable insights and practical strategies for parents to teach their children about money management. Here are the key takeaways from the book:

- Start Early: Basic money concepts can be introduced to preschoolers, and key financial habits are formed by age seven.

- Parental Influence: Parents are the primary influence on their children’s financial behaviors; leading by example is crucial.

- Focus on Values: Teaching values like delaying gratification, hard work, and generosity is more important than just teaching financial facts.

- Beyond Allowance: Allowances are not the only method for teaching money management; alternative approaches can be more effective.

- Age-Appropriate Financial Tools: Learn the right age to introduce tools like credit cards to your kids.

- Cash Can Be Good: Giving children cash can be a beneficial strategy when teaching money management.

- Accessible for All: The book is designed for parents of all financial backgrounds, making financial literacy attainable regardless of income level.

- Fun and Engaging: The book presents financial lessons in a charming and enjoyable way, making learning about money a positive experience for both parents and children.

Final Thoughts

“Make Your Kid A Money Genius (Even If You’re Not)” by Beth Kobliner is an invaluable resource for parents seeking to equip their children with essential financial skills from a young age. The book breaks down complex financial concepts into practical, easy-to-understand advice, making it accessible for parents of all backgrounds. It emphasizes the importance of instilling core values like delayed gratification, hard work, and generosity, which are crucial for lifelong financial success.

- Research-backed insights on when children can grasp money concepts.

- Practical strategies for teaching financial literacy from ages 3 to 23.

- Emphasis on values over mere financial mechanics.

- Helpful tips for parents, regardless of their own financial expertise.

This book is not just about managing money; it’s about raising financially savvy and responsible adults. Don’t miss out on the opportunity to empower your children with the knowledge and values they need to thrive financially. Purchase your copy of Make Your Kid A Money Genius (Even If You’re Not) today and start your journey towards financial literacy as a family!