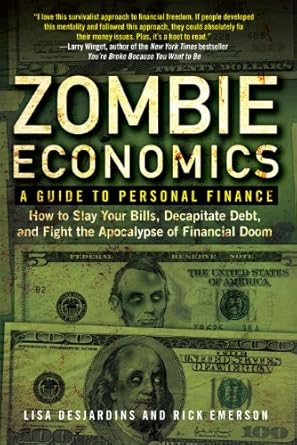

Are you feeling overwhelmed by financial jargon and mounting bills? Look no further than Zombie Economics: A Guide to Personal Finance. This refreshingly straightforward guide transforms the complex world of personal finance into digestible, actionable advice that can truly change your life. Whether you’re battling unpaid bills or dodging aggressive creditors, this book arms you with the tools to confront and conquer your financial zombies.

With engaging chapters like “A Basement Full of Ammo,” which teaches you the vital importance of saving, and “They’ll Eat the Fat Ones First,” where fitness becomes your financial ally, Zombie Economics offers a unique blend of humor and practical wisdom. Say goodbye to financial confusion and hello to empowerment as you learn to identify and eliminate your financial weak spots. Dive in and turn from a victim into a survivor today!

Zombie Economics: A Guide to Personal Finance

Why This Book Stands Out?

- Engaging Narrative: Unlike traditional financial guides that can be dry or overwhelming, Zombie Economics uses a compelling narrative to keep you invested in your financial journey.

- Straightforward Guidance: The book breaks down complex financial concepts into easily digestible strategies, making it accessible even for those new to personal finance.

- Real-Life Applications: With chapters like “A Basement Full of Ammo” and “They’ll Eat the Fat Ones First,” it provides practical tips that can be applied to everyday life, transforming theory into action.

- Unique Perspective: The zombie metaphor vividly illustrates the dangers of financial neglect, making the stakes clear and motivating readers to take control of their finances.

- Empowerment Focus: Rather than just avoiding pitfalls, Zombie Economics equips readers with the tools to actively strengthen their financial position, turning them from victims into survivors.

Personal Experience

When I first stumbled upon Zombie Economics: A Guide to Personal Finance, I was grappling with my own financial uncertainties. Like many, I had tried various financial guides that promised to demystify the complexities of personal finance but often left me feeling even more lost. This book, however, was different. The title alone sparked my curiosity, and as I delved into its pages, I found a refreshing approach to a topic that can often feel overwhelming.

The metaphor of zombies is brilliantly used throughout the book, making it relatable and engaging. I could easily visualize my own financial struggles as a horde of zombies creeping closer, threatening to overtake my peace of mind. The way the author addresses common financial pitfalls resonates deeply with anyone who has ever felt the weight of unpaid bills or the anxiety of looming creditors.

- A Basement Full of Ammo: The chapter on saving money struck a chord with me. It wasn’t just about cutting costs; it was about empowering myself to take control of my financial destiny. I started to see my savings as a form of ammunition in the battle against financial chaos.

- They’ll Eat the Fat Ones First: The unique perspective of using fitness as a financial asset was eye-opening. I realized that taking care of my health could also lead to financial savings, reinforcing the idea that our choices in one area of our lives can significantly impact another.

- Shooting Dad in the Head: This chapter particularly resonated with me as it tackled the often-taboo subject of ending relationships that drain our financial well-being. It challenged me to evaluate my own connections and consider how they were affecting my financial health.

As I navigated through the book, the straightforward language and actionable advice made it feel like I was having a conversation with a trusted friend. The author’s ability to break down complex concepts into digestible pieces gave me the confidence to confront my financial fears head-on. This book didn’t just teach me about personal finance; it transformed my mindset, turning me from a victim of my circumstances into an empowered survivor ready to tackle my financial zombies.

Who Should Read This Book?

Are you feeling overwhelmed by your finances? Do you find traditional financial guides too complicated or just plain boring? If so, Zombie Economics: A Guide to Personal Finance is the perfect read for you! This book is specially designed for anyone who is grappling with financial uncertainty and is ready to take charge of their economic future.

Whether you’re a recent graduate just starting out, a parent juggling bills and responsibilities, or someone who’s faced unexpected financial challenges, this book offers straightforward advice that can truly transform your approach to money. Here’s why Zombie Economics is the right choice for you:

- If you’re confused by traditional finance advice: This book breaks down complex financial concepts into easy-to-understand language, making it accessible for everyone.

- If you’re tired of feeling stuck: Zombie Economics provides practical strategies to identify and eliminate your financial weak spots, empowering you to take action.

- If you want to change your mindset: The unique, engaging approach will inspire you to rethink how you view money and your financial decisions.

- If you’re looking for relatable examples: With chapters that address real-life scenarios, you’ll find advice that resonates with your own experiences.

- If you’re ready to take control: This book is designed to turn financial victims into survivors, equipping you with the tools you need to thrive.

Don’t let financial uncertainty keep you in a state of confusion or panic. If you’re ready to face your financial fears head-on and emerge victorious, Zombie Economics is the guide you need!

Zombie Economics: A Guide to Personal Finance

Key Takeaways

Zombie Economics: A Guide to Personal Finance offers practical insights and actionable strategies for anyone facing financial challenges. Here are the most important lessons and benefits you can expect from this engaging read:

- Clear Guidance: The book simplifies complex financial concepts, making them accessible and easy to understand.

- Proactive Strategies: Learn how to identify and eliminate your financial weak spots before they become overwhelming issues.

- Real-Life Applications: Discover how fitness can serve as a financial asset, encouraging you to integrate health into your financial planning.

- Relationship Management: Gain insights on how to recognize and sever ties with financially detrimental relationships.

- Empowerment: Transform from a victim of your financial circumstances into a proactive survivor ready to tackle challenges head-on.

- Actionable Techniques: Utilize straightforward techniques to improve your financial situation and build a more stable future.

Final Thoughts

If you find yourself overwhelmed by traditional financial guides that often leave you more confused than empowered, then Zombie Economics: A Guide to Personal Finance is the refreshing change you need. This book is designed to cut through the jargon and provide straightforward advice that can truly transform your financial landscape.

Written for anyone facing financial uncertainty, this engaging guide tackles the pressing issues that can threaten your personal economy. With vivid metaphors and actionable strategies, it helps you identify and eliminate your financial weak spots, turning you from a victim into a survivor.

Here are some compelling reasons to consider adding this book to your collection:

- Practical Advice: Offers simple techniques for managing your finances effectively.

- Unique Perspective: Uses entertaining themes to discuss serious financial topics.

- Empowerment: Encourages readers to take control of their financial futures.

Don’t let financial uncertainty leave you feeling like a zombie. Embrace the knowledge and skills you need to thrive! Invest in your future by reading Zombie Economics. Click here to purchase your copy today!