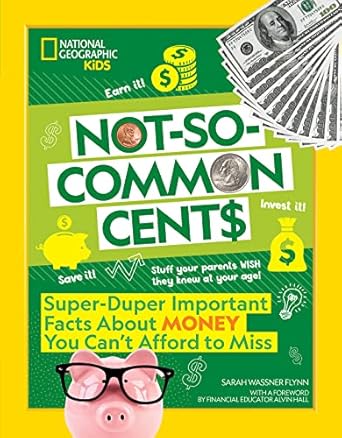

Unlock the secrets of financial literacy with “Not-So-Common Cents: Super Duper Important Facts About Money You Can’t Afford to Miss.” This engaging book is designed to equip readers of all ages with essential money management skills, from earning and saving to investing and understanding the stock market. Dive into a world where money isn’t just about transactions; it’s about building a secure future and becoming a savvy global citizen.

Whether you’re a curious child or an adult wishing for a financial do-over, this book offers invaluable insights into the basics of money, including innovative saving hacks, the real meaning of credit, and the exciting realm of cryptocurrency. Embrace the journey toward financial independence and discover why being smart with money is crucial for everyone. Grab your copy today and start mastering the art of managing your finances!

Not-So-Common Cents: Super Duper Important Facts About Money You Can’t Afford to Miss

Why This Book Stands Out?

- Essential Knowledge: Teaches critical money management skills that adults wish they had learned in childhood.

- Comprehensive Coverage: Covers a wide range of topics including saving, investing, credit, and the stock market.

- Engaging and Accessible: Uses fun and relatable language to make complex financial concepts understandable for young readers.

- Real-World Relevance: Connects money concepts to everyday life, emphasizing its necessity in daily activities.

- Innovative Ideas: Offers creative strategies for earning and growing money, encouraging entrepreneurial thinking.

- Modern Insights: Introduces contemporary financial topics such as cryptocurrency, preparing readers for the future of money.

- Social Responsibility: Highlights the importance of giving back, promoting the idea of being a responsible global citizen.

- Path to Independence: Stresses that smart financial decisions are essential for personal freedom and independence.

Personal Experience

As you dive into Not-So-Common Cents, you may find yourself reflecting on your own journey with money. Whether you’re a teenager just starting to understand financial concepts or an adult looking to refresh your knowledge, this book offers relatable insights that can resonate on multiple levels. Here are some potential experiences you might encounter:

- Rediscovering Basics: You might remember the first time you received an allowance or earned money from a summer job. The book’s foundational lessons on saving and budgeting can rekindle those early lessons and help you appreciate their importance.

- Understanding Mistakes: Many readers may relate to past financial missteps, such as impulse purchases or neglecting to save. The candid discussions about credit and debt can feel particularly relevant, reminding you that it’s never too late to learn and improve.

- Excitement of Investing: If you’ve ever been curious about investing but didn’t know where to start, this book demystifies the stock market and cryptocurrency. You might feel inspired to explore these avenues, sparking a newfound interest in your financial future.

- Empowerment through Knowledge: Learning about financial literacy can be empowering. Readers may find that grasping concepts like interest and compound growth boosts their confidence, making them feel more in control of their financial decisions.

- Giving Back: The book emphasizes the importance of philanthropy. Many readers may resonate with the idea of using their financial knowledge to help others, fostering a sense of community and responsibility.

Ultimately, Not-So-Common Cents isn’t just a book about money; it’s a journey towards financial empowerment that encourages you to reflect on your past, embrace your present, and confidently shape your future.

Who Should Read This Book?

This book is ideal for a diverse range of readers seeking to enhance their financial literacy and understanding of money management:

- Children and Teens: Young readers will gain essential knowledge about money that is often overlooked in traditional education, helping them make informed financial choices in the future.

- Parents and Guardians: This book serves as a valuable resource for adults looking to educate their children about financial responsibility and the importance of money management from an early age.

- Educators: Teachers and educators can utilize this book as a teaching tool to introduce financial concepts in a fun and engaging way, making learning about money accessible and enjoyable.

- Anyone Interested in Financial Literacy: Adults who feel unprepared for managing their finances will find practical tips and insights that can help them navigate the financial world confidently.

By reading “Not-So-Common Cents,” you’ll discover practical strategies and valuable insights that empower you to take control of your financial future.

Not-So-Common Cents: Super Duper Important Facts About Money You Can’t Afford to Miss

Key Takeaways

Readers of Not-So-Common Cents: Super Duper Important Facts About Money You Can’t Afford to Miss can expect to gain a wealth of knowledge about financial literacy and responsibility. Here are the key insights and lessons you will learn:

- Understanding the evolution of money from bartering to modern currency.

- Essential saving strategies and innovative hacks to help grow your savings.

- Clarification of what credit means and how it impacts financial decisions.

- Creative ideas to generate income and expand your financial portfolio.

- An overview of the stock market and the dynamics of global money movement.

- Insights into cryptocurrency and its role in the current financial landscape.

- The significance of philanthropy and giving back in building financial responsibility.

- How smart money management leads to greater independence and stability.

Final Thoughts

“Not-So-Common Cents: Super Duper Important Facts About Money You Can’t Afford to Miss” is an essential read for anyone looking to build a solid foundation in financial literacy. This informative book breaks down complex concepts into engaging and easily digestible lessons, making it perfect for kids and adults alike. The practical tips and insights provided will empower readers to make informed decisions about their finances, ensuring they are well-prepared for the future.

- Comprehensive overview of money management.

- Engaging explanations of saving, investing, and credit.

- Insightful look into modern financial tools like cryptocurrency.

- Encourages a mindset of giving back and financial responsibility.

- Promotes independence through smart financial choices.

Don’t miss out on the opportunity to transform your understanding of money and set yourself up for success. Buy “Not-So-Common Cents” today and unlock the secrets to financial wisdom that you can’t afford to miss!