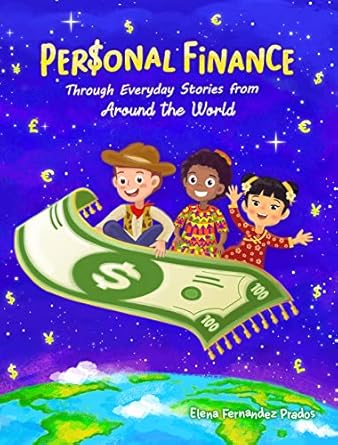

Looking for a fun and engaging way to teach your kids about personal finance? *Personal Finance through Everyday Stories from around the World* is the perfect guide! This delightful book combines real-life examples with captivating stories from diverse cultures, making financial literacy accessible and enjoyable for both kids and parents. With hands-on activities, your family will learn the essentials of managing money, saving, and investing in a way that’s easy to understand.

Empower your child to boost their financial IQ and build sustainable wealth from an early age. From understanding the basics of stocks and bonds to avoiding common financial pitfalls, this book equips young readers with the knowledge they need to navigate their financial futures confidently. Don’t miss the chance to instill valuable money management skills that will last a lifetime!

Personal Finance through Everyday Stories from around the World: Growing money, saving and investing for kids (Financial Literacy for Kids Book 2) [Print Replica]

Why This Book Stands Out?

- Engaging Stories: Dive into a vibrant collection of real-life stories from around the globe that make learning about finance relatable and fun for kids.

- Hands-On Activities: Packed with interactive activities that encourage practical learning, ensuring kids grasp financial concepts through action.

- Comprehensive Topics: Covers essential financial literacy topics including saving, investing, stocks, and bonds, all tailored for a younger audience.

- Family Focus: Designed for both kids and parents, fostering family discussions around money management and financial independence.

- Avoid Common Pitfalls: Teaches children how to recognize and avoid frequent financial mistakes, setting them up for a more secure future.

- Global Perspective: Introduces financial concepts through diverse cultural stories, making learning inclusive and broadening children’s horizons.

Personal Experience

As I turned the pages of “Personal Finance through Everyday Stories from around the World,” I couldn’t help but reflect on my own childhood and the lessons about money that I wish I had learned earlier. Growing up, the topic of finances was often shrouded in mystery and complexity, leaving many of us to navigate the adult world of money without a clear roadmap. This book resonates deeply with me because it tackles those very challenges in a way that is not only accessible but also incredibly engaging for kids and their parents alike.

The real-life stories from various cultures provide a unique lens through which we can explore financial concepts. I found myself reminiscing about my own experiences—like the first time I earned my own money from a summer job and how little I understood about saving or investing. I can imagine how impactful it would have been to have a resource like this at my fingertips, guiding me through similar experiences with relatable anecdotes and practical advice.

- Building Wealth Early: The idea that kids can start building wealth at a young age is empowering. I wish I had known that simple habits like saving a portion of my allowance could lead to greater financial independence later in life.

- Wise Money Management: The book’s emphasis on earning, saving, and investing wisely reminds me of the mistakes I made in my early twenties, trying to navigate credit cards and loans without any guidance.

- Understanding Bonds and Stocks: My journey to understand the stock market was filled with confusion. I can envision how the engaging stories in this book can demystify these concepts for young readers, making them feel less daunting.

- Avoiding Common Financial Mistakes: It’s comforting to know that readers can learn about the pitfalls to avoid, helping them make informed decisions and steering clear of the financial traps that many adults fall into.

Overall, “Personal Finance through Everyday Stories” is more than just a book; it’s a treasure trove of knowledge that resonates on a personal level. It opens up conversations about money that can bridge generational gaps, equipping the next generation with the tools they need for a financially savvy future. I can already envision parents and children bonding over these stories, discussing their own experiences and dreams, and building a foundation for a financially literate household.

Who Should Read This Book?

If you’re a parent or guardian looking to equip your child with essential life skills, this book is tailor-made for you! “Personal Finance through Everyday Stories from around the World” is not just another finance book; it’s a vibrant, engaging resource that makes learning about money fun and relatable for kids. Here’s why this book is perfect for you and your young readers:

- Parents and Guardians: You’ll find practical tools and insights to teach your children about money management, saving, and investing in a way that resonates with them.

- Educators: This book is an excellent resource for teachers looking to incorporate financial literacy into their curriculum. The real-life stories and activities will keep students engaged!

- Kids Aged 7-12: The fun stories and relatable examples make complex financial concepts accessible and enjoyable for young minds.

- Caregivers: Whether you’re a grandparent, aunt, or uncle, this book provides a fantastic way to bond with your kids while teaching them invaluable skills.

- Anyone Interested in Financial Literacy: If you believe in the importance of financial knowledge and want to foster it in the next generation, this book is a must-read.

By choosing this book, you’re not just reading a story; you’re investing in your child’s future! It’s all about making financial literacy a family affair, and this book does just that with its engaging approach.

Personal Finance through Everyday Stories from around the World: Growing money, saving and investing for kids (Financial Literacy for Kids Book 2) [Print Replica]

Key Takeaways

This book is a fantastic resource for both kids and parents looking to better understand personal finance. Here are the most important insights and benefits readers can expect:

- Learn how to build wealth from a young age with practical, actionable advice.

- Discover effective strategies for earning, saving, and investing money wisely.

- Understand the fundamentals of bonds and stocks in a simple and engaging way.

- Avoid common financial mistakes by learning from real-life stories and examples.

- Engage in fun activities that reinforce financial concepts and make learning enjoyable.

- Boost your child’s financial literacy and confidence in managing money.

- Explore diverse financial perspectives through stories from around the world.

Final Thoughts

Personal Finance through Everyday Stories from around the World is more than just a book—it’s a gateway to financial literacy for both children and their parents. This engaging guide simplifies complex financial concepts through relatable stories and interactive activities, making learning about money a fun and enriching experience.

With a focus on essential skills such as:

- Building wealth from an early age

- Wise earning, saving, and investing practices

- Understanding bonds and stocks

- Avoiding common financial pitfalls

This book serves as a valuable resource for families looking to foster a strong financial foundation. By sharing lessons from around the globe, it not only teaches kids important money management skills but also encourages curiosity about diverse cultures and practices.

Don’t miss the chance to boost your child’s financial IQ and set them on a path toward financial independence. Make this essential guide a part of your family’s library today! Purchase your copy now!