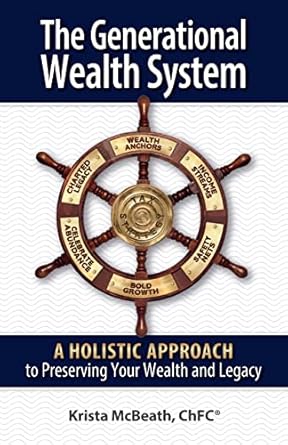

Are you ready to take control of your financial future and create a lasting legacy? “The Generational Wealth System: A Holistic Approach to Preserving Your Wealth and Legacy” by acclaimed financial planner Krista McBeath offers a refreshing perspective on retirement and wealth management. This insightful guide empowers you to protect your lifestyle in retirement while ensuring your loved ones are cared for, all without sacrificing your current way of life. With practical strategies to combat taxes, healthcare costs, and market fluctuations, this book is your roadmap to a secure financial future.

McBeath’s personal stories and engaging analogies make complex financial concepts accessible and enjoyable. Whether you’re looking to safeguard your family’s future or make a meaningful impact through philanthropic endeavors, this book is tailored for legacy makers like you. Don’t leave your financial destiny to chance—invest in your legacy today and discover how to thrive while protecting what matters most!

The Generational Wealth System: A Holistic Approach to Preserving Your Wealth and Legacy

Why This Book Stands Out?

- Holistic Approach: Unlike traditional retirement guides, this book offers a comprehensive perspective on wealth management that prioritizes your lifestyle while safeguarding your legacy.

- Real-Life Stories: Krista McBeath enriches the content with personal anecdotes and relatable analogies, making complex financial concepts both entertaining and easy to understand.

- Proven Strategies: Discover essential tactics for maintaining sustainable cash flow, managing taxes, and neutralizing threats to your wealth, ensuring you can enjoy retirement without worry.

- Philanthropic Insights: Learn how to engage in ‘Giving while Living’ ventures, allowing you to make a difference while still enjoying your own wealth.

- Expert Guidance: Benefit from the expertise of a leading financial planner and an estate planning attorney, providing you with actionable advice for wealth transfer and asset protection.

- Legacy Focused: This book is designed for those who care deeply about their loved ones and wish to leave a meaningful legacy, not just a financial one.

Personal Experience

As I dove into The Generational Wealth System, I couldn’t help but reflect on my own journey with financial planning and the legacy I wish to leave behind. I’ve often found myself grappling with the complexities of retirement planning, feeling overwhelmed by the traditional approaches that seemed to ignore the nuances of my personal situation. Krista McBeath’s holistic perspective resonated deeply with me, as it offered a refreshing take that felt both relatable and actionable.

Reading through her personal stories and analogies, I found myself nodding along, realizing that I’m not alone in my struggles. The book made me think about my family and the legacy I want to create for them. It reminded me of those quiet moments spent with loved ones, discussing dreams and aspirations—what if I could actively shape those dreams through careful planning?

- Identifying Threats: McBeath’s insights on recognizing potential threats to my retirement and family’s future were eye-opening. I had never considered how lurking threats could undermine my plans until I read her strategies for neutralizing them.

- Investing with Confidence: The ‘secret keys’ to investing without fear spoke to my hesitation in the market. I realized that I, too, can adopt a mindset that embraces growth while being mindful of risks.

- Giving while Living: The concept of philanthropy as a means to enrich not just my family but also the causes I care about was incredibly inspiring. It encouraged me to think beyond mere wealth accumulation and consider how my actions can create a meaningful impact.

- Estate Planning Insights: Learning about estate planning tactics, especially the use of trusts, opened my eyes to the importance of structuring my affairs to reflect my wishes, protecting my assets for future generations.

- Tax Management: The emphasis on understanding and managing tax stages was a game-changer for me. I realized how crucial it is to incorporate tax strategies into my overall financial planning.

This book is more than just a guide; it feels like a heartfelt conversation with a trusted friend who genuinely cares about my family’s future. It’s a reminder that planning for retirement and legacy isn’t just about numbers—it’s about love, care, and ensuring that my values and dreams continue to thrive long after I’m gone. Embracing this journey has never felt so empowering, and I can’t wait to implement the strategies McBeath shares.

Who Should Read This Book?

If you’re someone who cares deeply about your family’s future, financial security, and leaving a meaningful legacy, then The Generational Wealth System is just the book for you! This guide is perfect for a variety of readers who are looking to take control of their financial journey and ensure their loved ones are well taken care of. Here’s who will benefit the most:

- Families Planning for the Future: If you want to ensure that your hard-earned wealth is preserved for your children and future generations, this book offers insights on effective wealth transfer strategies.

- Retirees Seeking Peace of Mind: For those approaching retirement who are worried about maintaining their lifestyle while managing healthcare costs and inflation, this book provides practical solutions.

- Philanthropists at Heart: If you believe in making a difference through charitable giving, you’ll discover how to incorporate philanthropic ventures into your financial plan.

- Anyone Unsure About Traditional Retirement Planning: If traditional methods have left you feeling confused or dissatisfied, Krista McBeath’s holistic approach will clarify how everything fits together and empower you to take action.

- Financial Stewards: For those who want to be proactive about their financial legacy, this book offers a systematic approach to managing wealth that reflects your values and priorities.

In The Generational Wealth System, you’ll find a friendly, relatable guide that not only informs but also inspires you to take charge of your financial destiny. With personal stories and practical advice, Krista makes the complex world of wealth management accessible and engaging. Don’t wait to secure your legacy—this book is your roadmap to a meaningful financial future!

The Generational Wealth System: A Holistic Approach to Preserving Your Wealth and Legacy

Key Takeaways

If you’re looking to create a meaningful legacy while maintaining your lifestyle in retirement, “The Generational Wealth System” offers invaluable insights. Here are the key lessons and benefits you can expect from this enlightening read:

- Comprehensive Cash Flow Planning: Learn the essentials of developing a sustainable cash flow plan that keeps your lifestyle intact while addressing rising costs and market uncertainties.

- Identify and Neutralize Risks: Discover how to spot and mitigate potential threats to your retirement and legacy, ensuring long-term security.

- Investment Strategies for Growth: Uncover the secrets successful investors use to achieve growth without the fear of market fluctuations.

- Philanthropic Ventures: Understand how ‘Giving while Living’ can benefit both you and your loved ones, providing a fulfilling way to share your wealth.

- Effective Estate Planning: Gain insights from a leading attorney on using trusts to protect your assets and ensure your wishes are honored after you’re gone.

- Tax Management: Learn to navigate the three major tax stages crucial for a comprehensive financial strategy, allowing you to protect your wealth from unnecessary tax burdens.

- A Holistic Approach: Embrace a well-rounded perspective on wealth management that prioritizes the well-being of your family and future generations.

This book is not just about growing wealth; it’s about shaping a lasting legacy that reflects your values and care for your loved ones.

Final Thoughts

In a world where traditional retirement planning often leaves individuals feeling uncertain about their financial future, The Generational Wealth System: A Holistic Approach to Preserving Your Wealth and Legacy by Krista McBeath stands out as a beacon of clarity and hope. This insightful guide is not just about securing a comfortable retirement; it’s about crafting a meaningful legacy that reflects your values and supports your loved ones long after you’re gone.

With her engaging storytelling and practical advice, Krista McBeath demystifies complex financial concepts, empowering readers to take charge of their financial destinies. Here are some key takeaways that make this book a must-have:

- Learn how to create a sustainable cash flow plan that preserves your lifestyle while addressing rising costs.

- Discover strategies to identify and mitigate potential threats to your retirement and legacy.

- Understand how successful investors navigate market fluctuations without fear.

- Explore the benefits of ‘Giving while Living’ and how to integrate philanthropy into your wealth management.

- Gain insights into essential estate planning tactics that ensure your wishes are honored and assets are protected.

- Master the management of tax stages to safeguard your wealth from unnecessary burdens.

Whether you’re just starting your financial journey or looking to refine your existing plans, this book offers a holistic approach that resonates with the values of family and legacy. Don’t let your hard-earned wealth be at the mercy of others. Take control today!

Ready to secure your future and create a lasting impact? Click here to purchase your copy of The Generational Wealth System now!