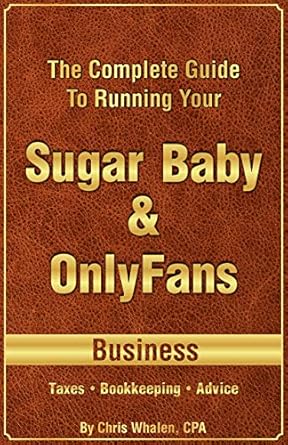

Are you an OnlyFans content creator or a Sugar Baby navigating the complexities of running your own business? Look no further! “The Complete Guide To Running Your OnlyFans & Sugar Baby Business” is your essential resource for mastering taxes, bookkeeping, and business strategies tailored specifically for your unique needs. Authored by Chris Whalen, a Certified Public Accountant with over 30 years of experience, this comprehensive guide breaks down the financial ins and outs in an easy-to-understand manner.

From filing your income tax returns and managing your accounting records to understanding whether you should form an LLC, this book answers all your pressing questions. It’s designed for those new to the business world, offering step-by-step guidance to help you feel confident and informed in your financial journey. Don’t let the complexities of taxes hold you back—empower yourself with the knowledge and support you need to thrive!

The Complete Guide To Running Your OnlyFans & Sugar Baby Business | Taxes • Bookkeeping • Business Advice

Why This Book Stands Out?

- Expert Guidance: Authored by Chris Whalen, a Certified Public Accountant with 30 years of experience, this book offers professional insights tailored specifically for OnlyFans creators and Sugar Babies.

- Comprehensive Coverage: From filing income tax returns to bookkeeping and banking practices, this guide covers all essential aspects to help you navigate your new business.

- Beginner-Friendly: Written for those new to the business world, the book simplifies complex tax and accounting concepts, making it accessible for anyone.

- Step-by-Step Instructions: Clear, actionable advice that breaks down the processes, ensuring you know exactly what to do at each stage of your business journey.

- Supportive Resources: With direct access to Chris’s CPA firm, you have ongoing support to help you succeed beyond just reading the book.

Personal Experience

As I sat down to read “The Complete Guide To Running Your OnlyFans & Sugar Baby Business,” I couldn’t help but reflect on my own journey in the world of entrepreneurship. Like many of you, I remember that initial rush of excitement when I first decided to take control of my financial future. The independence was exhilarating, but the complexities of managing a business—especially one in the digital space—were daunting.

Have you ever felt overwhelmed by the thought of filing your income tax returns? I certainly have. The fear of making a mistake and the sheer amount of paperwork can seem insurmountable. This book addresses those very concerns, breaking down the intricacies of tax filing into digestible segments. It’s like having a mentor by your side, guiding you through the process with clarity and compassion.

Moreover, the chapter on bookkeeping struck a chord with me. I remember my early days of juggling receipts and trying to figure out which expenses I could actually deduct. It was chaotic! This guide offers practical tips and tricks that I wish I had known back then. With its structured approach, you can transform your accounting from a headache into a streamlined process.

Here are a few key insights I found particularly relatable:

- The importance of understanding your business structure—whether you should form an LLC or not is a pivotal decision that can impact your finances.

- Strategies for effective record-keeping that can save you time and stress come tax season.

- Tangible advice on how to manage banking and separate your personal and business finances, an essential step for every new entrepreneur.

Reading this book felt like sitting down with a trusted friend who has your best interests at heart. It’s more than just a guide; it’s a source of reassurance that you’re not alone in this journey. Each page resonates with the struggles and victories that come with being a content creator or a sugar baby, making it a relatable companion as you navigate the business world.

Who Should Read This Book?

If you’re an OnlyFans content creator or a sugar baby, then this book is tailor-made for you! Whether you’re just starting out or have been in the game for a while, navigating the business side of your hustle can feel daunting. This guide is here to simplify everything for you, making it a must-read for anyone in this unique space.

Here’s why this book is perfect for you:

- New Entrepreneurs: If you’ve never run a business before, this book breaks down the essentials of taxes, bookkeeping, and financial management in a way that’s easy to understand.

- Content Creators: Specifically designed for OnlyFans creators, it addresses your unique challenges, helping you understand how to manage your income effectively.

- Sugar Babies: Learn the ins and outs of maintaining your financial independence while managing your earnings responsibly.

- Anyone Feeling Overwhelmed: If tax season gives you anxiety, this book will alleviate your fears by guiding you step-by-step through the process.

- Curious About LLCs: Unsure whether you need to form a Limited Liability Company? This book explores that and helps you make informed decisions.

In short, if you’re eager to take control of your financial future and want to learn from a seasoned expert, this guide is your go-to resource. With Chris Whalen’s 30 years of CPA experience, you’ll gain invaluable insights that will empower you every step of the way!

The Complete Guide To Running Your OnlyFans & Sugar Baby Business | Taxes • Bookkeeping • Business Advice

Key Takeaways

This book is a must-read for anyone navigating the worlds of OnlyFans or sugar baby work. Here are the key insights and benefits you can expect:

- Tax Filing Made Simple: Learn the ins and outs of filing your income tax returns specific to your OnlyFans or sugar baby income.

- Understanding Payment Deadlines: Get clear guidance on when you need to pay your taxes to avoid penalties.

- Effective Bookkeeping Practices: Discover practical methods to keep track of your accounting books and records effortlessly.

- Banking Insights: Understand how to handle banking effectively within your business model.

- Business Structure Guidance: Find out if forming an LLC is right for you and how it can benefit your business.

- Expert Advice from a CPA: Benefit from the author’s 30 years of experience as a Certified Public Accountant, ensuring you receive reliable and professional insights.

- Supportive Resources: Access additional assistance from the author’s CPA firm to help you at every stage of your journey.

Final Thoughts

If you’re an OnlyFans content creator or a sugar baby navigating the complexities of your new business, The Complete Guide To Running Your OnlyFans & Sugar Baby Business is an invaluable resource tailored just for you. With over 30 years of experience as a Certified Public Accountant, Chris Whalen provides clear, practical advice that demystifies the world of taxes, bookkeeping, and business management.

This comprehensive guide covers essential topics such as:

- How to file your income tax returns

- Understanding when and how to pay your taxes

- Keeping accurate accounting records

- Navigating banking options for your business

- Deciding whether to form an LLC

Whether you’re a seasoned entrepreneur or just starting your journey, this book will empower you with the knowledge and confidence to handle your business finances effectively. You’ll no longer feel overwhelmed by tax obligations or bookkeeping challenges. Instead, you’ll be equipped to flourish in your business.

Don’t miss out on the opportunity to transform your approach to managing your OnlyFans or sugar baby business. Take the first step towards financial clarity and success by purchasing your copy today! Get your guide here!