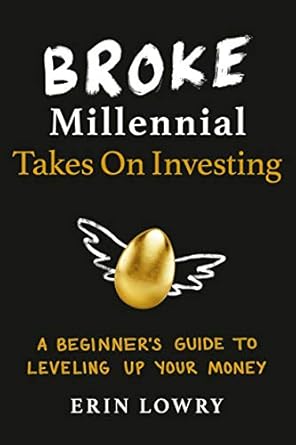

Are you a millennial feeling overwhelmed by the idea of investing? Look no further than “Broke Millennial Takes On Investing: A Beginner’s Guide to Leveling Up Your Money.” In this insightful guide, Erin Lowry breaks down the complexities of investing into manageable bites, addressing the unique concerns of new investors like you. From managing student loans while investing to exploring socially responsible options and understanding robo-advisors, this book is your go-to resource for navigating the financial landscape.

With practical advice and relatable insights, Lowry empowers you to take charge of your financial future. Whether you’re curious about stock trading or retirement savings, this guide covers all the essentials to help you build confidence in the market. Say goodbye to confusion and hello to a wealth-building journey with “Broke Millennial Takes On Investing!”

Broke Millennial Takes On Investing: A Beginner’s Guide to Leveling Up Your Money (Broke Millennial Series)

Why This Book Stands Out?

- Tailored for Millennials: Written specifically for the millennial audience, this guide addresses the unique financial challenges and concerns of young adults entering the investment world.

- Comprehensive and Accessible: Erin Lowry breaks down complex investing concepts into digestible, relatable content, making it easy for beginners to grasp the essentials.

- Real-life Relevance: The book tackles pressing questions like balancing student loans with investing and socially responsible options, ensuring readers feel understood and supported.

- Hands-on Approach: With practical advice on using robo-advisors, apps, and online resources, it equips readers with the tools they need to confidently navigate the investment landscape.

- Empowerment through Knowledge: Lowry not only explains investment terminology but also addresses emotional aspects of investing, helping readers manage anxiety and build confidence.

Personal Experience

As I delved into the pages of Broke Millennial Takes On Investing, I couldn’t help but reflect on my own journey with money and investing. Like many millennials, I often felt overwhelmed by the thought of diving into the world of stocks and bonds, especially with the weight of student loans hanging over my head. Erin Lowry’s relatable tone and straightforward advice made me feel like I was having a heart-to-heart with a friend who truly understood my struggles.

There were moments when I found myself nodding along, recalling late-night conversations with friends about whether we should prioritize paying off debt or start investing. The questions Erin poses in the book resonated deeply:

- Should I invest while paying down student loans?

- How do I invest in a socially responsible way?

- What about robo-advisors and apps–are any of them any good?

- Where can I look online for investment advice?

These are not just theoretical concerns; they are real dilemmas faced by many of us. Erin’s insightful answers provided clarity and a sense of direction that I desperately needed. I appreciated how she tackled the anxiety that often accompanies financial decisions, reminding me that it’s okay to feel uncertain. Her approachable style made complex topics digestible, and I found myself feeling empowered rather than daunted by the prospect of investing.

As I turned the pages, I discovered practical tips that I could implement right away, which made me feel like I was taking control of my financial future. The way Erin breaks down investing terminology transformed what once felt like a foreign language into a familiar conversation. I could almost hear her encouraging voice as I learned how to buy and sell stocks, and it sparked a newfound confidence in me.

In reflecting on my own experiences and the lessons shared in this book, I realized that investing isn’t just for the wealthy; it’s for anyone willing to learn and grow. Broke Millennial Takes On Investing isn’t just a guide—it’s a companion on the journey toward financial literacy and empowerment. I can only imagine how many others will find their own stories within these pages, and I truly believe it’s a book that can change lives.

Who Should Read This Book?

If you’re a millennial feeling overwhelmed by the world of investing, then this book is tailor-made for you! Whether you’re just starting your career, navigating student loans, or trying to make sense of your financial future, “Broke Millennial Takes On Investing” is the perfect companion on your journey to financial empowerment.

Here’s why this book is ideal for you:

- New Investors: If you’ve never dabbled in investing before, Erin Lowry breaks down complex concepts into bite-sized, digestible pieces, making it easy for you to understand the basics.

- Budget-Conscious Readers: For those who think they need to be rich to invest, this guide reassures you that you can start with whatever you have, even while managing student debt.

- Socially Responsible Investors: If you’re passionate about investing in a way that aligns with your values, this book discusses how to make socially responsible choices.

- Tech-Savvy Millennials: With the rise of robo-advisors and investment apps, you’ll learn how to navigate these tools effectively and determine which ones suit your needs.

- Those Seeking Confidence: If you feel anxious about entering the market, this book will arm you with knowledge and strategies to build your confidence as an investor.

“Broke Millennial Takes On Investing” is more than just an investment guide; it’s a roadmap that empowers you to take charge of your financial future with clarity and confidence. If you’re ready to level up your money, this book is the perfect place to start!

Broke Millennial Takes On Investing: A Beginner’s Guide to Leveling Up Your Money (Broke Millennial Series)

Key Takeaways

This book is a must-read for anyone looking to navigate the world of investing, especially millennials who may feel overwhelmed or unsure about where to start. Here are the key insights and benefits you can expect:

- Beginner-Friendly Approach: Erin Lowry breaks down complex investment concepts into easy-to-understand language, making it accessible for newcomers.

- Addressing Common Concerns: The book tackles pressing questions like whether to invest while paying off student loans and how to choose socially responsible investments.

- Exploration of Tools: Learn about various investment tools, including robo-advisors and apps, and discover which options may be best suited for your financial goals.

- Confident Decision-Making: Gain insights on how to handle anxiety associated with investing, empowering you to make informed decisions and take action.

- Comprehensive Overview: From basic terminology to practical steps on buying and selling stocks, this guide covers all the essential knowledge needed to start investing.

- Long-Term Wealth Building: Understand the importance of retirement savings and how to strategically grow your wealth over time.

Final Thoughts

If you’re a millennial feeling overwhelmed by the world of investing, Broke Millennial Takes On Investing: A Beginner’s Guide to Leveling Up Your Money is the perfect resource for you. Erin Lowry skillfully demystifies the complex landscape of investing, making it accessible and relatable for newcomers. This book addresses the unique concerns of millennials, such as managing student loans while investing, exploring socially responsible options, and navigating the various tools available like robo-advisors and investment apps.

With practical advice and straightforward explanations, Lowry covers essential topics including:

- Investment terminology made easy

- Strategies to handle anxiety related to investing

- Retirement savings insights

- A step-by-step guide on buying and selling stocks

Whether you’re just starting out or looking to deepen your understanding, this guide will empower you to take charge of your financial future and build wealth confidently. Don’t miss out on this invaluable addition to your financial education.

Ready to take the plunge into the world of investing? Purchase your copy of Broke Millennial Takes On Investing today and start your journey towards financial success!