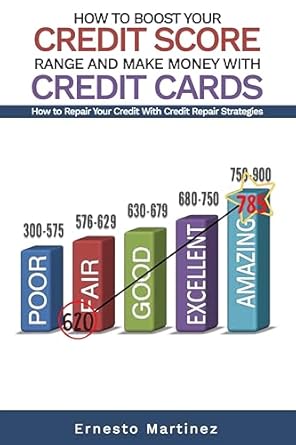

If you’re looking to boost your credit score and unlock new financial opportunities, “How to Boost Your Credit Score Range and Make Money With Credit Cards” is the ultimate guide for you! This comprehensive book reveals proven strategies to repair your credit quickly and effectively, helping you improve your score in just hours. Whether you’re aiming to secure a new apartment, buy a car, or obtain a business loan, Dr. Ernesto Martinez provides a step-by-step game plan that will empower you to take control of your financial future.

Imagine reducing your mortgage interest rate from 6.25% to 4.5% simply by enhancing your credit score! This book not only teaches you the fundamentals of credit repair but also shows you how to leverage credit cards to generate income. With practical tips on managing debt, understanding credit systems, and investing wisely, you’ll be well on your way to financial success. Don’t miss out on the chance to transform your credit and your life!

How to Boost Your Credit Score Range and Make Money With Credit Cards.: How to Repair Your Credit With Credit Repair Strategies. (Entrepreneurship Book 3)

Why This Book Stands Out?

- Comprehensive Credit Repair Strategies: Learn effective techniques to repair and boost your credit score quickly, empowering you to seize new opportunities.

- Real-Life Success Stories: The author shares personal experiences, demonstrating how strategic credit repair led to significant financial savings and improved loan terms.

- Financial Literacy: Gain a deep understanding of how the credit system operates, enabling you to make informed decisions about your finances.

- Practical Applications: Discover how to use credit cards wisely to invest in real assets, generating new income streams and maximizing your financial potential.

- Targeted Advice for All: Whether you’re a college student or a seasoned investor, this book offers tailored insights to help you navigate the world of credit effectively.

- Monthly Cash Flow System: Learn to develop a cash flow strategy that can yield thousands of dollars monthly, transforming your approach to credit and investments.

- Expert Endorsement: Recommended by credit counselors, this book is backed by credible professionals, ensuring you receive trusted guidance.

Personal Experience

As I dove into the pages of “How to Boost Your Credit Score Range and Make Money With Credit Cards,” I couldn’t help but reflect on my own financial journey. Like many, I’ve faced the daunting reality of a low credit score and the rippling effects it can have on every aspect of life. It’s easy to feel overwhelmed when you realize that a few missteps can lead to missed opportunities, whether it’s securing a dream apartment or getting that car you’ve had your eye on.

The anecdotes shared in the book struck a chord with me. I remember the frustration of being quoted high interest rates, feeling trapped by my financial situation. Dr. Martinez’s personal story about refinancing his mortgage resonated deeply. It reminded me of the time I, too, had to confront the impact of my credit history. The feeling of empowerment that comes from taking action and improving your score is indescribable. It’s like lifting a heavy weight off your shoulders.

As I explored the credit repair strategies laid out in the book, I found myself nodding along, realizing that I wasn’t alone in my struggles. Here are a few key reflections that I believe many readers might relate to:

- Awareness is Key: The realization that negative items on my credit report were affecting my score was a wake-up call. This book emphasizes the importance of understanding what’s on your report and how to address inaccuracies.

- Small Changes Matter: The strategies for paying down credit card debt and managing finances effectively reminded me that even small steps can lead to significant improvements over time.

- Empowerment through Education: Learning how the credit system works demystified a lot of my fears. This book provides the knowledge needed to navigate the complexities of credit.

- Potential for Growth: The idea of using credit cards as tools for investment rather than just debt was a revelation. It opened my eyes to new possibilities for building wealth.

Reading this book felt like a personal conversation with a mentor who genuinely wants to help you succeed. It’s not just about repairing credit; it’s about transforming your financial future. I could see how following the outlined strategies could lead to a more secure and prosperous life, filled with opportunities that once felt out of reach. If you’ve ever felt stuck or uncertain about your finances, this book could be the guiding light you need.

Who Should Read This Book?

If you’re feeling stuck due to a low credit score or simply want to enhance your financial literacy, this book is for you! Whether you’re a student, a young professional, or someone looking to improve their financial situation, the strategies outlined in this guide can help you achieve your goals.

Here’s why this book is perfect for you:

- Individuals with Low Credit Scores: If your credit score is holding you back from securing loans, renting an apartment, or even buying a car, this book provides practical steps to help you repair your credit quickly.

- Students and Recent Graduates: Navigating the world of credit can be overwhelming. This book explains the importance of credit scores and how to manage credit cards responsibly, setting you up for a successful financial future.

- Homebuyers: If you’re looking to refinance or buy a home, understanding how to improve your credit score can save you thousands of dollars in interest payments. This guide offers clear strategies to elevate your score efficiently.

- Small Business Owners: A healthy credit score is crucial for securing business loans. This book outlines how to enhance your credit profile, enabling you to make informed financial decisions for your business.

- Anyone Interested in Financial Independence: This book is not just about repairing credit; it’s about using credit strategically to build wealth. Learn how to leverage your credit to invest in real assets and create new income streams.

By following the insights and strategies in this book, you’ll not only boost your credit score but also unlock a world of financial opportunities. Don’t miss out on the chance to take control of your financial future!

How to Boost Your Credit Score Range and Make Money With Credit Cards.: How to Repair Your Credit With Credit Repair Strategies. (Entrepreneurship Book 3)

Key Takeaways

This book offers essential insights into improving your credit score and leveraging credit cards for financial success. Here are the key points that make it worth your time:

- Understanding Credit Repair: Learn how to identify and rectify negative items on your credit report that may be hindering your score.

- Maximizing Credit Benefits: Discover strategies to optimize the advantages of having good credit, including lower interest rates and better loan options.

- Importance of Credit Scores: Gain insights into why maintaining a healthy credit score is crucial for financial opportunities like renting a home or purchasing a vehicle.

- Using Credit Wisely: Understand the difference between credit and debit cards, and how to use credit cards as tools for investment rather than just for spending.

- Monthly Cash Flow System: Get tips on developing a system that can generate significant income and help you invest in real assets like real estate.

- Learning from Real Experiences: Benefit from real-life examples, including the author’s journey from a low credit score to significant savings on mortgage interest.

- Building Income Streams: Discover how to use credit to create new avenues for income, enhancing your financial stability and wealth-building potential.

Final Thoughts

If you’re looking to take control of your financial future and boost your credit score, “How to Boost Your Credit Score Range and Make Money With Credit Cards” is an indispensable resource. This book delves into the fundamental principles of credit repair and offers practical strategies that can lead to immediate improvements in your credit score, opening doors to better financial opportunities.

Through relatable anecdotes and expert insights, Dr. Ernesto Martinez guides you on a journey to not only repair your credit but also leverage it as a powerful tool for building wealth. Here’s what you can expect:

- Understanding how the credit system works and its importance

- Step-by-step credit repair strategies that yield quick results

- Insightful discussions on the advantages and disadvantages of credit cards

- How to use credit cards strategically to invest and create income streams

This book is more than just a guide; it’s a game plan for financial success. Whether you’re a college student just starting out, a homeowner looking to refinance, or anyone in between, the knowledge contained within these pages is essential for anyone interested in improving their finances and achieving new heights.

Don’t miss out on the opportunity to transform your credit and financial situation. Take the first step towards a brighter financial future by purchasing your copy today! Click here to buy the book now!