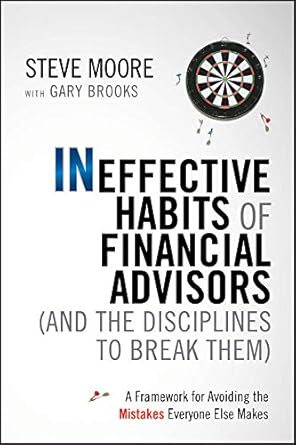

If you’re a financial advisor looking to elevate your practice and avoid common pitfalls, “Ineffective Habits of Financial Advisors (and the Disciplines to Break Them)” by Steve Moore is your essential guide. Based on a comprehensive 15-year consulting program, this insightful book provides proven techniques that can transform your business into an elite practice. Through engaging storytelling, it introduces you to the journey of a fictional financial advisor, revealing ineffective habits and the disciplines needed to overcome them, ensuring you deliver exceptional service while increasing revenue per client.

Each chapter is packed with actionable strategies, real-life anecdotes, and thought-provoking homework assignments to help you refine your skills. From developing a strategic vision to enhancing client relationships without relying on cold calls, this book equips you with the tools necessary to attract high net worth clients and elevate your service. Don’t miss out on the opportunity to enhance your professional journey; let this framework guide you toward success!

Ineffective Habits of Financial Advisors (and the Disciplines to Break Them): A Framework for Avoiding the Mistakes Everyone Else Makes

Why This Book Stands Out?

- Proven Expertise: Based on 15 years of consulting experience, Steve Moore offers insights that have been tested and refined in real-world scenarios.

- Engaging Narrative: The book employs a relatable story of a fictional financial advisor, making complex concepts easy to understand and apply.

- Actionable Strategies: Each chapter presents a common ineffective habit paired with a discipline to break it, providing a clear path to improvement.

- Comprehensive Guidance: Covers essential areas such as business analysis, strategic vision, and exceptional client service to elevate your practice.

- Interactive Learning: Includes Q&A segments, examples, and homework assignments that encourage practical application of the material.

- Focus on High-Value Clients: Teaches techniques for acquiring and servicing high net worth clients, boosting potential revenue.

- Client-Centric Approach: Emphasizes delivering exceptional service, ensuring higher revenue per client without relying on cold calling.

Personal Experience

As I delved into Ineffective Habits of Financial Advisors (and the Disciplines to Break Them), I found myself reflecting on my own journey through the world of finance. The insights shared by Steve Moore felt like a mirror, reflecting not only the struggles of the fictional advisor but also the challenges many of us face in our professional lives. Have you ever felt stuck in a rut, repeating the same mistakes despite your best intentions? This book speaks directly to that feeling.

Moore’s approach, grounded in relatable anecdotes and practical strategies, made me ponder my own habits—both effective and ineffective. It’s easy to fall into routines that seem harmless but ultimately hinder growth. Here are a few key takeaways that resonated with me:

- Understanding Ineffective Habits: I realized that recognizing my own ineffective habits was the first step toward transformation. The book encourages us to confront these habits head-on, just as the fictional advisor does.

- Practical Strategies: The step-by-step strategies outlined in the book reminded me of the importance of having a clear action plan. It’s not enough to identify issues; we need to actively work on solutions.

- Value of Client Relationships: The emphasis on nurturing existing client relationships rather than solely focusing on new ones struck a chord with me. It’s a perspective shift that can lead to deeper connections and greater satisfaction in our work.

- Anecdotes That Resonate: The stories shared throughout the book are not just for illustration; they evoke emotions and experiences we can all relate to, making the lessons feel more accessible and applicable.

- Engaging with the Content: I appreciated the interactive elements, such as homework assignments and Q&A segments. They encouraged me to actively engage with the material rather than passively absorb it, making the learning process more impactful.

In sharing this journey with the book, I found not just a guide, but a companion that resonates on a deeply personal level. The insights offered are invaluable for anyone looking to refine their approach and elevate their practice, reminding us that we are all capable of growth and change.

Who Should Read This Book?

If you’re a financial advisor looking to elevate your practice and avoid common pitfalls, this book is tailor-made for you! Whether you’re just starting out or you’re a seasoned professional, “Ineffective Habits of Financial Advisors” offers valuable insights that can transform your approach to client relationships and business growth.

Here’s why this book is perfect for you:

- New Financial Advisors: If you’re new to the industry, this book provides a solid foundation by helping you identify and break ineffective habits before they become ingrained in your practice.

- Experienced Advisors: For those who have been in the business for years, it’s a refreshing reminder of the basics, combined with advanced strategies to refine your approach and increase your revenue.

- Client-Centric Professionals: If you pride yourself on exceptional client service, this book will help you enhance that focus, ensuring that you not only meet but exceed client expectations.

- Advisors Seeking Growth: If you’re aiming to attract high net worth clients and grow your practice sustainably, the proven techniques outlined in this guide will provide the roadmap you need.

- Anyone Interested in Professional Development: Even if you’re not a financial advisor, the strategies discussed can apply to anyone in a client service role looking to improve their effectiveness and value delivery.

By diving into the experiences of a fictional advisor, you’ll find relatable anecdotes and practical advice that you can easily apply to your own practice. This book isn’t just about avoiding mistakes; it’s about building a resilient and successful financial advisory business that stands out from the crowd. So, if you’re ready to break ineffective habits and embrace a disciplined approach to your work, this book is the perfect companion on your journey!

Ineffective Habits of Financial Advisors (and the Disciplines to Break Them): A Framework for Avoiding the Mistakes Everyone Else Makes

Key Takeaways

Reading Ineffective Habits of Financial Advisors (and the Disciplines to Break Them) by Steve Moore offers invaluable insights for financial advisors looking to elevate their practices. Here are the most important lessons and benefits you can expect from this guide:

- Identify Ineffective Habits: Explore common pitfalls that financial advisors fall into and learn how to recognize them in your own practice.

- Implement Proven Disciplines: Each chapter presents a specific discipline designed to counter ineffective habits, providing actionable strategies for improvement.

- Enhance Client Relationships: Discover techniques to deliver exceptional service and nurture existing client relationships rather than relying on cold calling.

- Strategic Business Analysis: Gain insights into conducting a thorough analysis of your business to identify areas for growth and improvement.

- Develop a Strategic Vision: Learn how to create a clear and effective vision that guides your practice towards becoming an elite operation.

- Attract High Net Worth Clients: Understand the strategies to effectively acquire and retain high net worth clients for sustainable growth.

- Real-World Anecdotes: Benefit from personal stories and experiences that illustrate key concepts, making the lessons relatable and practical.

- Interactive Learning: Engage with question and answer segments, examples, and homework assignments to reinforce your learning and application of the material.

Final Thoughts

In “Ineffective Habits of Financial Advisors (and the Disciplines to Break Them),” author Steve Moore offers a transformative guide that addresses the common pitfalls faced by financial advisors. Through relatable storytelling, he illustrates how a fictional yet typical advisor navigates the complexities of the industry, making it easy for readers to connect with the material. This book serves as an invaluable resource, packed with proven techniques to elevate your practice into an elite financial advisory service.

By focusing on:

- Identifying ineffective habits that can hinder success

- Implementing disciplines that lead to improved business results

- Providing exceptional client service and building lasting relationships

- Attracting high net worth clients through strategic vision and analysis

The practical insights, anecdotes, and actionable strategies presented throughout the book make it a must-read for anyone looking to enhance their career in financial advising. Whether you are just starting out or are a seasoned professional, this book will empower you to break free from ineffective practices and unlock your full potential.

Don’t miss the opportunity to transform your approach and achieve greater success. Purchase your copy today!