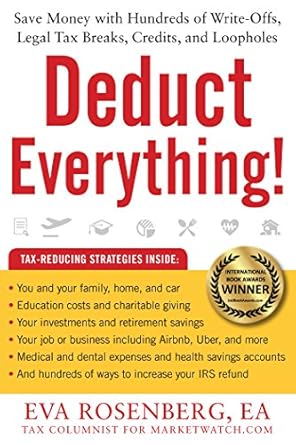

Are you tired of watching a hefty portion of your hard-earned money vanish come tax season? Say goodbye to overpaying the IRS with Deduct Everything!, your essential guide to unlocking hundreds of legal tax breaks, credits, and write-offs. Awarded in the “Business: Personal Finance/Investing” category of the 2016 International Book Awards, this comprehensive resource empowers you to navigate the complex tax code and keep more of your money where it belongs—in your pocket!

With practical tips on record-keeping, maximizing deductions for work-related expenses, and leveraging healthcare savings, Deduct Everything! is designed to transform your tax experience. Discover secrets to mortgage and insurance deductions, as well as strategies to make the most of your education expenses. Plus, enjoy bonus insights on how to boost your income, some of which can be tax-free. Get ready to reclaim your finances and save more this tax season!

Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and Loopholes

Why This Book Stands Out?

- Award-Winning Insight: Celebrated as the winner in the “Business: Personal Finance/Investing” category of the 2016 International Book Awards, this book brings authority and expertise to your tax strategies.

- Comprehensive Coverage: Packed with hundreds of legal tax breaks, credits, write-offs, and loopholes, it provides an extensive roadmap to minimize your tax bill effectively.

- Practical Tips: Learn essential record-keeping and organizational strategies that simplify the often-overwhelming tax process, making it more manageable for you.

- Maximize Your Deductions: Discover secrets to optimizing mortgage, tax, and insurance deductions, as well as work-related and medical expenses, ensuring you keep more of your hard-earned money.

- Educational Benefits: Gain insights into leveraging deductions and credits for education, making it easier to invest in your future while saving on taxes.

- Bonus Money-Making Tips: Enjoy additional strategies for earning more income, with a focus on opportunities that may even be tax-free.

Personal Experience

As I delved into the pages of Deduct Everything!, I couldn’t help but feel a wave of relief wash over me. Tax season has always been a daunting time, filled with anxiety and uncertainty about how much I would owe. I know I’m not alone in this; many of us dread the thought of sifting through mountains of receipts and documents, hoping to find even a shred of a deduction to lessen our tax burden.

Reading this book felt like having a wise friend guiding me through the often-murky waters of tax laws. The author presents the information in a way that is not only accessible but also incredibly relatable. I found myself nodding along as I read about the common pitfalls many taxpayers encounter—like neglecting to keep track of work-related expenses or overlooking the potential benefits of health savings accounts. It sparked memories of my own experiences, where I missed out on significant deductions simply because I didn’t know they existed.

What truly resonated with me was the emphasis on organization and record-keeping. I remembered those frantic moments when I scrambled to find last year’s receipts, only to realize I had tossed them in a drawer somewhere. The practical tips for staying organized felt like a lifeline, offering me a clear path to avoiding that chaos in the future.

Here are a few key insights that particularly struck a chord with me:

- Record-Keeping Made Easy: The rules of thumb provided in the book made me rethink my approach to organizing my finances. I could almost envision a system that would save me time and stress.

- Maximizing Deductions: The secrets to mortgage and insurance deductions opened my eyes to opportunities I hadn’t considered before. It was like discovering hidden treasures in my financial landscape.

- Tax-Free Income Strategies: Learning about ways to earn money that could be tax-free felt empowering. It provided a new perspective on my financial goals and how to achieve them without the burden of taxes weighing me down.

As I absorbed the wealth of information, I felt a growing sense of confidence. This book not only equips readers with the knowledge to navigate the complexities of taxes, but it also inspires a proactive mindset toward financial management. I could envision myself entering tax season with a strategy, ready to tackle it head-on instead of bracing for impact.

Who Should Read This Book?

If you’re tired of feeling overwhelmed at tax time or if you’re simply looking to keep more of your hard-earned money in your pocket, then Deduct Everything! is the perfect book for you! This comprehensive guide is designed for a variety of readers who want to navigate the often-confusing world of tax deductions, credits, and loopholes.

- Small Business Owners: If you run a business, this book will help you discover valuable write-offs that can significantly reduce your taxable income.

- Freelancers and Independent Contractors: Learn how to maximize your work-related expenses and keep more of your earnings.

- Families: Find out about deductions related to childcare, education, and medical expenses that can ease your financial burden.

- First-Time Homebuyers: Unlock the secrets to mortgage and tax deductions that can make homeownership more affordable.

- Students and Parents: Benefit from strategies that allow you to take full advantage of education-related deductions and credits.

- Anyone Looking to Save Money: Even if you’re not a business owner or student, the tips in this book can help anyone reduce their tax bill and increase their savings.

This book stands out because it not only provides a wealth of information on deductions but also offers practical advice on record-keeping and staying organized. It’s like having a tax expert by your side, guiding you through the process and helping you feel confident about your financial decisions. With Deduct Everything!, you’ll gain the knowledge you need to make the most of the tax code and keep your finances on track.

Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and Loopholes

Key Takeaways

If you’re looking to minimize your tax bill and keep more of your hard-earned money, “Deduct Everything!” is a must-read. Here are the most important insights and benefits you’ll gain from this comprehensive guide:

- Effective Record-Keeping: Learn essential rules of thumb for organizing your financial documents and maintaining accurate records to make tax time easier.

- Maximize Deductions: Discover secrets to taking full advantage of mortgage, tax, and insurance deductions that can significantly reduce your taxable income.

- Work-Related Expense Strategies: Explore how to maximize deductions related to your job, ensuring you don’t leave money on the table.

- Medical Expense Insights: Understand how to navigate medical expenses and health savings accounts to optimize your tax savings.

- Education Deductions and Credits: Get strategies for utilizing education-related deductions and credits to lower your tax liability.

- Bonus Tips for Extra Income: Benefit from practical advice on generating additional income, including opportunities that may be tax-free.

Final Thoughts

In today’s complex financial landscape, understanding the ins and outs of the tax code is essential for anyone looking to keep more of their hard-earned money. Deduct Everything! is not just a book; it’s a comprehensive roadmap to navigating the often overwhelming world of tax deductions, credits, and loopholes. Awarded in the “Business: Personal Finance/Investing” category of the 2016 International Book Awards, this guide offers invaluable insights that can lead to significant savings at tax time.

With practical advice on record-keeping, maximizing work-related expenses, and utilizing medical expense deductions, this book equips you with the tools you need to make informed financial decisions. Moreover, it goes beyond just deductions by sharing strategies to enhance your income—some of which can be tax-free!

- Learn the essential rules of thumb for efficient record-keeping.

- Discover secrets to maximizing mortgage, tax, and insurance deductions.

- Uncover strategies for leveraging educational deductions and credits.

- Get tips on how to increase your income while minimizing taxes.

Whether you’re a seasoned taxpayer or just starting out, Deduct Everything! is a worthwhile addition to your financial toolkit. Don’t miss the opportunity to save money and empower yourself with knowledge. Take the first step toward a more financially savvy future by purchasing your copy today!

Click here to buy Deduct Everything!