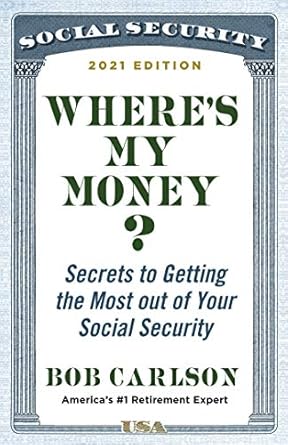

Are you ready to retire without regrets? Don’t let the biggest retirement mistake catch you off guard—failing to maximize your Social Security benefits. In his insightful guide, Where’s My Money?: Secrets to Getting the Most out of Your Social Security, America’s #1 retirement expert, Bob Carlson, unveils the secrets to navigating the complexities of Social Security. This easy-to-follow resource is designed to help you make informed choices that can significantly impact your financial future.

With practical advice on timing your benefits, minimizing taxes, and understanding the potential pitfalls, Carlson empowers you to take control of your retirement planning. Whether you’re unsure about claiming strategies or want to avoid common mistakes, this book is your go-to guide for securing a prosperous retirement. Don’t leave your financial future to chance—discover how to make the most of your Social Security benefits today!

Where’s My Money?: Secrets to Getting the Most out of Your Social Security

Why This Book Stands Out?

- Expert Guidance: Authored by Bob Carlson, America’s #1 retirement expert, ensuring that you’re learning from a trusted source with years of experience.

- Comprehensive Insights: Delivers a deep dive into Social Security, covering everything from optimal claiming times to tax minimization strategies.

- Avoid Common Pitfalls: Highlights the most frequent mistakes retirees make, empowering you to make informed decisions and avoid regret.

- Practical Strategies: Offers actionable advice on calculating longevity risk and understanding the impact of working on your benefits.

- Clear and Accessible: Written in an easy-to-follow format, making complex topics understandable for everyone.

- Avoid Misinformation: Educates readers on why they can’t rely solely on the Social Security Administration for accurate advice.

- Timely Decisions: Emphasizes the crucial importance of timing in claiming benefits to maximize your retirement income.

Personal Experience

As I picked up “Where’s My Money?: Secrets to Getting the Most out of Your Social Security,” I couldn’t help but feel a wave of anticipation mixed with a touch of anxiety. Like many, I’ve often heard the phrase, “You need to plan for retirement,” but the nuances of Social Security have always felt overwhelming. I remember sitting down with friends and family, discussing our futures, only to realize that most of us were muddled in confusion about how to navigate this crucial aspect of our golden years.

Bob Carlson’s approachable writing style drew me in immediately. His insights made me reflect on my own plans and the decisions I was considering. It’s easy to think that claiming Social Security is a straightforward process, but Carlson’s revelations about the timing of benefits and potential pitfalls opened my eyes to the complexities involved. I found myself nodding along as I read about how the wrong choice could impact my financial stability for decades to come.

- The importance of timing: I had always thought claiming benefits at age 62 was the best option, but Carlson made me reconsider. What if waiting a few more years could mean a significantly larger monthly benefit?

- Tax implications: The section on how to minimize taxes was particularly enlightening. I had no idea that my Social Security benefits could be taxed based on my retirement income. This is crucial information that I wish I had known sooner!

- Longevity risk: The concept of calculating how long my savings might last in conjunction with Social Security really struck a chord. It made me think about my long-term health and financial needs, something I had previously brushed aside.

- Realistic expectations: Carlson’s candid discussion on the reliability of information from the Social Security Administration was a wake-up call. It’s a reminder that I need to take charge of my own financial education.

This book isn’t just a guide; it feels like a conversation with a trusted friend who genuinely wants you to avoid the common pitfalls of retirement planning. As I flipped through the pages, I couldn’t help but feel empowered, knowing that making informed decisions would lead to a more secure and fulfilling retirement. I can already see how the lessons learned from this book will resonate with me as I continue on my journey toward financial independence.

Who Should Read This Book?

If you’re approaching retirement age or already enjoying your golden years, “Where’s My Money?: Secrets to Getting the Most out of Your Social Security” is a must-read for you! This book is perfect for anyone who wants to make the most of their Social Security benefits and avoid the common pitfalls that can lead to financial regret.

Here’s why this book is ideal for you:

- Pre-Retirees: If you’re nearing retirement, this book will guide you on the best time to claim your benefits, ensuring you maximize your income during your retirement years.

- Current Retirees: If you’ve already claimed your benefits but feel uncertain about your decision, Bob Carlson’s insights can help you make adjustments to improve your financial situation.

- Financial Planners: If you’re a financial advisor helping clients navigate retirement, this book provides valuable strategies to share with those looking to optimize their Social Security benefits.

- Individuals Planning for the Future: Even if retirement is a few years away, understanding Social Security now can help you plan better and make informed decisions as you approach that milestone.

This book stands out because it doesn’t just present facts and figures; it offers a clear, actionable plan to navigate the complexities of Social Security. With Bob Carlson’s expert guidance, you’ll feel empowered to make informed choices that can significantly enhance your financial well-being in retirement. Don’t leave your future to chance—grab a copy and take control of your Social Security benefits today!

Where’s My Money?: Secrets to Getting the Most out of Your Social Security

Key Takeaways

If you’re nearing retirement or planning for your financial future, “Where’s My Money?: Secrets to Getting the Most out of Your Social Security” is an essential read. Here are the most important insights you’ll gain from this guide:

- Timing Matters: Discover the optimal time to claim your Social Security benefits to maximize your income.

- Lump Sum Decisions: Learn whether taking a lump sum benefit is the right choice for your financial situation.

- Tax Strategies: Uncover smart strategies to minimize your tax liability through informed Social Security decisions.

- Impact of Work: Understand how continuing to work can affect your benefits and what you need to know before making that choice.

- Longevity Risk: Calculate your “longevity risk” to ensure you don’t outlive your savings.

- Adjusting Claims: Find out when it’s possible to change your benefits claim and when it isn’t.

- Critical Advice: Realize why you shouldn’t rely solely on the Social Security Administration for accurate guidance.

- Comprehensive Insights: Benefit from a wealth of information aimed at helping you avoid common pitfalls and regrets in your retirement planning.

Final Thoughts

Are you ready to take control of your retirement and avoid the common pitfalls that many face when it comes to Social Security? In Where’s My Money?: Secrets to Getting the Most out of Your Social Security, Bob Carlson, America’s #1 retirement expert, provides invaluable insights that can help you maximize your benefits and ensure a financially secure future. This easy-to-follow guide is packed with essential knowledge that every retiree should have.

Here’s what you’ll gain from this must-read book:

- Understanding the optimal time to claim your benefits and why it matters.

- Insights into whether a lump sum benefit is right for you.

- Strategies to minimize your tax bill through smart Social Security choices.

- How your employment status can impact your benefits.

- Tools to calculate your longevity risk, ensuring you never run out of money.

- Critical information about when you can adjust your benefits claim.

- Why relying solely on the Social Security Administration for advice may not be the best choice.

This book is not just about understanding Social Security; it’s about empowering you to make informed decisions that will significantly affect your retirement lifestyle. Don’t be one of the millions who regret their Social Security choices—arm yourself with the knowledge you need to retire without regrets.

If you’re ready to enhance your understanding of Social Security and secure your financial future, purchase Where’s My Money? today and start your journey towards a worry-free retirement!