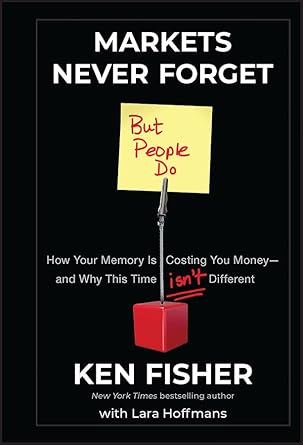

Unlock the secrets to smarter investing with “Markets Never Forget (But People Do)” by Ken Fisher. In this insightful book, Fisher—renowned Forbes columnist and CEO of Fisher Investments—delves into the pitfalls of our memories and how they can cost us money. Drawing inspiration from legendary investor Sir John Templeton’s wisdom, Fisher emphasizes that while history doesn’t repeat itself, it remains an invaluable guide for making informed investment decisions. This engaging read reveals the common mistakes investors make and offers practical steps to avoid them.

By understanding the lessons of the past, you can enhance your investment strategy and reduce costly errors. Fisher’s approachable writing style makes complex concepts easy to grasp, allowing you to see the world of investing more clearly. Whether you’re a seasoned investor or just starting out, “Markets Never Forget” is a must-read for anyone looking to sharpen their financial acumen and achieve greater success in the markets.

Markets Never Forget (But People Do):: How Your Memory Is Costing You Money–and Why This Time Isn’t Different (Fisher Investments Press Book 34)

Why This Book Stands Out?

- Insightful Perspective: Ken Fisher combines historical analysis with practical advice, showcasing how understanding the past can help investors navigate the present and future.

- Expert Author: As a long-time Forbes columnist and CEO of Fisher Investments, Fisher brings a wealth of knowledge and experience, making complex investment concepts accessible to all readers.

- Memory and Mistakes: The book dives deep into the psychology of investing, revealing how faulty memories can lead to costly errors and providing strategies to overcome them.

- Timeless Wisdom: Fisher emphasizes the importance of historical trends in investing, reinforcing the idea that while markets evolve, the lessons from the past remain invaluable.

- Actionable Steps: Readers will find practical steps to improve their investment decisions, empowering them to avoid common pitfalls and enhance their financial success.

Personal Experience

As I delved into the pages of Markets Never Forget But People Do, I found myself reflecting on my own journey with investing. Like many, I have experienced the high tides of market euphoria and the low valleys of market despair. There were moments when I thought I was making savvy decisions, only to find out later that I had fallen prey to my own biases and memories of past performance.

Ken Fisher’s insights resonated deeply with me. He articulates how our memories can distort our judgment, leading us to believe that the current market conditions are unlike anything we’ve seen before. I remember a specific instance when I hesitated to invest during a downturn, recalling the painful losses from the previous recession. It was only later that I realized this fear was rooted in my memory, not in the current fundamentals of the market.

Reading this book feels like having a candid conversation with a wise friend who gently reminds you of the lessons learned through history. It encourages introspection and a reassessment of the emotional triggers that often lead us astray in our financial decisions. Here are some key points that really struck me:

- Recognizing Patterns: The book emphasizes the importance of recognizing historical patterns in the market, which can help mitigate the fear and uncertainty that often accompany investment decisions.

- Overcoming Bias: Fisher provides practical advice on how to overcome cognitive biases that cloud our judgment, encouraging us to step back and analyze situations more objectively.

- Learning from Mistakes: I appreciated how the book highlights that acknowledging our past mistakes is crucial; it’s not about avoiding them entirely but learning to navigate them better in the future.

- Building a Stronger Future: By understanding the lessons of the past, we can build a more resilient investment strategy that prepares us for whatever comes next.

This book is not just about investing; it’s about understanding ourselves as investors. It’s a reminder that while markets are ever-changing, our response to them can be informed by history, allowing us to make better decisions moving forward. I encourage you to take this journey with Ken Fisher and explore how your memories might be shaping your investment choices, just as mine have shaped mine.

Who Should Read This Book?

If you’re someone who wants to navigate the complex world of investing with more confidence and clarity, then Markets Never Forget (But People Do) is the perfect book for you. Whether you’re a seasoned investor or just starting out, Ken Fisher’s insights are invaluable. Here’s why this book is a must-read for various audiences:

- New Investors: If you’re entering the investment world and feeling overwhelmed, this book provides a solid foundation. Fisher breaks down common pitfalls and helps you understand the importance of learning from history, so you can avoid making the same mistakes others have made.

- Experienced Investors: Even if you’ve been investing for years, it’s easy to fall into the trap of believing “this time is different.” Fisher’s reminders about historical patterns will encourage you to reassess your strategies and make more informed decisions.

- Financial Advisors: If you guide others in their investment journeys, this book equips you with critical insights to share with your clients. Understanding the psychological aspects of investing will help you provide better advice and foster stronger relationships with those you serve.

- History Buffs: If you have a passion for history and its relevance to our current lives, you’ll appreciate how Fisher connects historical events to present-day investment strategies. This perspective not only educates but also entertains.

- Anyone Looking to Improve Decision-Making: If you’re simply interested in enhancing your decision-making skills, this book offers practical steps to refine your thinking. Fisher’s analysis of memory and decision-making will be beneficial in both your personal and professional life.

In essence, Markets Never Forget (But People Do) offers something for everyone. Ken Fisher’s engaging writing style and wealth of experience make complex concepts accessible, ensuring that readers from all backgrounds can find value in his teachings. So, grab a copy, and start transforming your investment approach today!

Markets Never Forget (But People Do):: How Your Memory Is Costing You Money–and Why This Time Isn’t Different (Fisher Investments Press Book 34)

Key Takeaways

In “Markets Never Forget But People Do,” Ken Fisher delves into the critical lessons investors can learn from history to avoid common pitfalls. Here are the key insights that make this book a must-read:

- Understanding Historical Patterns: Learn how past market behaviors can inform your investment strategies and help you anticipate future trends.

- The Cost of Memory Errors: Discover how false memories and selective recollection can lead to costly investment mistakes.

- Recognizing Recurring Mistakes: Identify common errors that many investors make and understand how to avoid them in your own decision-making process.

- Developing a Clearer Perspective: Gain tools to see market events through a more informed lens, reducing the impact of emotional decision-making.

- This Time Isn’t Different: Understand why the belief that current market conditions are unique can be misleading and detrimental to investment success.

- Practical Steps for Improvement: Implement actionable strategies to improve your investment approach and mitigate the influence of cognitive biases.

Final Thoughts

In “Markets Never Forget (But People Do),” Ken Fisher offers invaluable insights into the timeless nature of investing and the common pitfalls that can lead to costly mistakes. Drawing on his extensive experience as a successful investor and columnist, Fisher emphasizes the importance of learning from history while recognizing that our memories can often mislead us. This book serves as a powerful reminder that while the market may change, the underlying principles of investing remain constant.

By understanding how our memories can distort our perceptions, readers will be equipped with strategies to make more informed decisions and avoid the traps that have ensnared countless investors in the past. Fisher’s engaging writing style and practical advice make this book not only educational but also enjoyable to read.

- Learn from historical patterns to guide future investments.

- Understand the psychological biases that affect decision-making.

- Gain actionable strategies to minimize costly errors.

Whether you’re a seasoned investor or just starting out, “Markets Never Forget” is a worthwhile addition to your collection. It will empower you to navigate the complexities of the market with greater confidence and clarity. Don’t miss out on the opportunity to enhance your investing acumen—purchase your copy today!