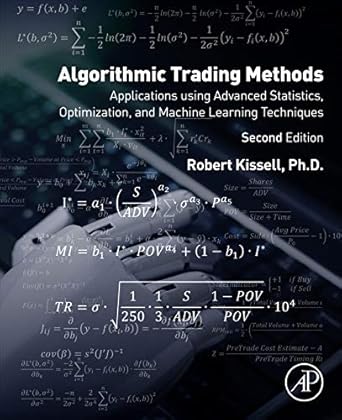

Unlock the full potential of your trading strategies with “Algorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning Techniques, Second Edition.” This essential sequel to “The Science of Algorithmic Trading and Portfolio Management” is packed with fresh insights and advanced techniques tailored for today’s dynamic financial landscape. Dive into new chapters covering everything from sophisticated trading analytics to compliance and regulatory reporting, making it a must-have for both novice and seasoned traders.

What sets this edition apart? It offers a comprehensive toolkit, including advanced modeling techniques with machine learning and predictive analytics. You’ll gain access to a suite of transaction cost analysis functions that can be easily integrated into various programming languages and software applications. With a focus on enhancing your trading execution and optimizing your portfolio, this book is your gateway to mastering algorithmic trading and staying ahead in the market.

Algorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning Techniques

Why This Book Stands Out?

- Comprehensive Coverage: Delves into advanced trading analytics, regression analysis, and optimization, providing a thorough understanding of modern algorithmic trading.

- Updated Insights: Features new chapters that reflect the latest trends and changes in the financial environment, ensuring readers are equipped with current knowledge.

- Advanced Techniques: Explores machine learning, predictive analytics, and neural networks, offering unique methodologies for enhancing trading strategies.

- Practical Tools: Includes a transaction cost analysis (TCA) library compatible with multiple programming languages and software applications, making it accessible for practitioners.

- In-depth Analysis: Covers essential topics such as market impact estimation, risk modeling, and compliance, providing a holistic view of algorithmic trading.

- Focus on Execution: Offers insights into the best execution process and model validation, crucial for achieving optimal trading outcomes.

- Rich Mathematical Foundation: Increased emphasis on mathematics, probability, and statistics, ensuring a solid grounding for complex trading models.

Personal Experience

As I delved into the pages of Algorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning Techniques, I found myself navigating through a realm that felt all too familiar yet exhilaratingly complex. The blend of advanced statistics and machine learning techniques resonated with my own journey into the world of finance and technology. It reminded me of the late-night coding sessions I spent trying to optimize trading algorithms, fueled by the thrill of discovery and the occasional frustration of debugging my own code.

What struck me most about this book was its practical approach. Each chapter felt like a conversation with a mentor, guiding me through the intricacies of algorithmic trading. The author’s insights into the ever-changing financial landscape echoed my own experiences of adapting strategies in response to market shifts. I could almost visualize the trading floor bustling with activity as I read about pre-trade and post-trade analyses, recalling moments when I grappled with similar challenges.

- The detailed exploration of transaction cost analysis brought back memories of my initial attempts at understanding how every trade can impact overall portfolio performance.

- Learning about advanced modeling techniques using machine learning felt like rediscovering a passion for data science that I had cultivated over the years.

- The discussions on compliance and regulatory requirements struck a chord, reminding me of the importance of maintaining integrity in trading practices.

This book holds the power to bridge the gap between theory and practice, making complex concepts accessible. I often found myself nodding along, reflecting on similar experiences and challenges I’ve faced in my career. The TCA library section, with its versatile applications, felt like a treasure trove waiting to be explored. I could envision myself implementing these tools in my own trading strategies, enhancing my approach with newfound knowledge.

Ultimately, Algorithmic Trading Methods not only enriched my understanding but also rekindled my passion for algorithmic trading. It’s more than just a textbook; it’s a companion for anyone eager to navigate the exciting yet daunting world of financial markets and trading strategies.

Who Should Read This Book?

If you’re passionate about finance and looking to enhance your trading skills, then this book is tailor-made for you! Whether you’re an aspiring trader, a seasoned professional, or someone who simply wants to understand the intricacies of algorithmic trading, you’ll find invaluable insights within these pages. Here’s why this book is perfect for you:

- Traders and Investors: If you’re actively involved in trading or investing, this book will provide you with advanced strategies and techniques to optimize your trades and improve your decision-making process.

- Data Scientists and Quantitative Analysts: For those with a background in data science, the advanced statistical methods and machine learning techniques discussed here will help you build sophisticated models that can predict market movements.

- Finance Students: If you’re studying finance or related fields, this book serves as an excellent resource to deepen your understanding of algorithmic trading and the mathematics behind it.

- Portfolio Managers: Gain insights into portfolio construction and optimization techniques that can enhance your investment strategies and risk management practices.

- Software Developers: With its comprehensive TCA library and programming tools compatible with various languages like Python, MATLAB, and Java, this book will empower you to create and implement your own trading algorithms.

In summary, whether you’re looking to refine your trading strategies, enhance your technical skills, or understand the latest trends in algorithmic trading, this book offers a wealth of knowledge that can elevate your expertise and confidence in the fast-paced world of finance!

Algorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning Techniques

Key Takeaways

This book, “Algorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning Techniques,” offers a wealth of insights and practical tools for anyone interested in the world of algorithmic trading. Here are the key points that make this book a must-read:

- Comprehensive Coverage: Delve into advanced trading analytics, regression analysis, and optimization strategies tailored for the evolving financial landscape.

- Enhanced Trading Strategies: Gain insights into pre-trade and post-trade analysis, liquidity costs, risk analysis, and compliance requirements essential for effective trading.

- Modern Techniques: Explore new investment techniques including model validation, quality assurance testing, and smart order routing analysis.

- Machine Learning Applications: Learn about advanced modeling techniques using machine learning, predictive analytics, and neural networks to enhance trading algorithms.

- Transaction Cost Analysis: Access a robust library of transaction cost analysis functions compatible with popular programming languages and software applications.

- In-Depth Mathematical Insights: Understand critical mathematics, probability, and statistics concepts as they apply to financial trading and portfolio management.

- Portfolio Optimization: Discover advanced multiperiod trade schedule optimization and techniques for effective portfolio construction.

- Broker-Dealer Model Insights: Decode complex broker-dealer and vendor models to improve trading outcomes.

- Practical Tools: Utilize the TCA library in various programming environments including MATLAB, Python, and Java to streamline your trading processes.

Final Thoughts

In the rapidly evolving world of finance, staying ahead of the curve is crucial for anyone involved in trading or investment strategies. Algorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning Techniques is an invaluable resource that bridges the gap between complex statistical theories and practical trading applications. This second edition not only expands on the foundational concepts introduced in its predecessor but also dives deeper into the intricacies of algorithmic trading, making it a must-have for both seasoned professionals and newcomers alike.

- Comprehensive insights into algorithmic trading strategies and models.

- In-depth coverage of advanced statistics, optimization techniques, and machine learning applications.

- Practical tools for transaction cost analysis and model validation.

- Accessible programming libraries for popular languages like Python, MATLAB, and Java.

- New chapters addressing current trends and regulatory requirements in the financial landscape.

This book is not just about theory; it’s a practical guide designed to enhance your trading capabilities and optimize your investment strategies. By incorporating the latest advancements in technology and analytics, it equips you with the tools you need to navigate the complexities of today’s financial markets successfully.

Don’t miss the opportunity to elevate your trading game. Purchase your copy today and unlock the potential of algorithmic trading with proven techniques and expert insights!