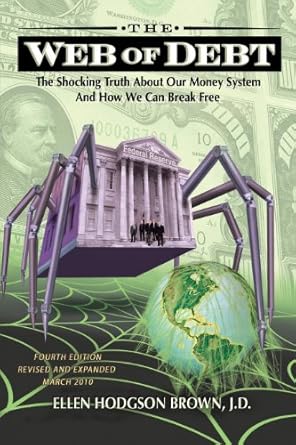

Discover the shocking truth about our money system with “Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free.” This eye-opening book dismantles the myths surrounding money creation and reveals how a private banking cartel has taken control, leaving us trapped in a cycle of debt. Learn how banks create money as loans, but only provide the principal, leading to a constant need for new loans that inflate prices and diminish the value of your hard-earned cash.

But it’s not all doom and gloom! “Web of Debt” also offers a hopeful alternative rooted in the economic wisdom of our Founding Fathers, like Benjamin Franklin and Thomas Jefferson. If you’re interested in securing your financial future and understanding the real mechanics behind our economy, this book is a must-read. It’s time to take back control and break free from the web of debt!

Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free

Why This Book Stands Out?

- Myth-Busting Insights: “Web of Debt” challenges conventional beliefs about our money system, revealing the privatization of money creation and its implications for everyday citizens.

- Clear Exposition: The author presents complex financial concepts in an accessible way, making it easy for readers to grasp the intricacies of our current monetary system.

- Historical Context: It draws on historical examples, including the economic philosophies of influential figures like Benjamin Franklin, Thomas Jefferson, and Abraham Lincoln, grounding its arguments in American history.

- Proposed Alternatives: The book doesn’t just expose the problems; it also offers a feasible solution rooted in past practices, providing hope for a more equitable financial future.

- Empowerment Through Knowledge: Readers will gain a deeper understanding of how money works, empowering them to make informed decisions about their financial wellbeing.

Personal Experience

When I first picked up Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free, I was immediately struck by how relevant its themes are to my everyday life. Like many of you, I’ve often found myself feeling overwhelmed by financial jargon and the seemingly endless cycle of debt. This book doesn’t just throw around statistics; it dives deep into the heart of the issues we face, resonating with my own struggles and fears about money.

As I read through the chapters, I couldn’t help but reflect on my personal experiences with banks and loans. It’s almost as if the book was shedding light on the hidden forces that have shaped my financial decisions. Have you ever felt trapped by the loans you’ve taken out, wondering how you’ll ever pay them back? This book articulates that feeling perfectly, exposing the cycle of debt that many of us find ourselves in.

Moreover, the insights about the privatization of money struck a chord with me. I realized that my understanding of money and its creation was far too simplistic. The idea that banks create money out of thin air as loans and that we need to continually borrow just to maintain our current lifestyle was a tough pill to swallow. It made me think about my spending habits and how often I’ve relied on credit to get by.

Here are a few key points that really resonated with me:

- The Myth of Money Creation: Understanding that money is largely created through loans made me reconsider how I view my financial choices.

- Historical Context: The book’s exploration of colonial America and the economic thoughts of figures like Benjamin Franklin and Abraham Lincoln provided a refreshing perspective that felt both grounding and inspiring.

- Personal Accountability: The narrative encouraged me to take a step back and assess my financial habits, pushing me towards a more conscious approach to spending and saving.

- A Call to Action: I found myself motivated to learn more about alternative financial systems and how we might reclaim our economic freedom.

Reading Web of Debt has been more than just an intellectual exercise; it has sparked a deeper reflection on my values regarding money and what financial security truly means. I believe many readers will find similar connections and insights that resonate deeply with their own experiences.

Who Should Read This Book?

If you’ve ever felt confused or frustrated by the complexities of our money system, or if you’re simply curious about how money really works, then Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free is the perfect read for you. This book is tailored for a diverse audience, including:

- Financial Beginners: If you’re just starting to learn about personal finance and economics, this book breaks down complicated concepts into easy-to-understand language, making it accessible to everyone.

- Concerned Citizens: Those who are worried about economic stability and the future of their financial security will find valuable insights that help explain the issues at play in our current system.

- Students and Educators: This book serves as a great resource for students of economics and finance, as well as educators looking for engaging material to supplement their teaching.

- Activists and Reformers: If you’re passionate about financial reform or social justice, you’ll appreciate the alternative solutions presented in this book, which can inspire action and change.

- History Buffs: Readers interested in American history will enjoy the exploration of ideas from founding figures like Benjamin Franklin and Thomas Jefferson, connecting past economic practices to contemporary issues.

By reading Web of Debt, you’ll not only gain a clearer understanding of the money system but also discover practical alternatives that could lead to a more equitable financial future. It’s a must-read for anyone who cares about their own financial well-being and the economic health of the nation!

Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free

Key Takeaways

Reading “Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free” provides valuable insights into the often misunderstood world of money creation and its implications for financial security. Here are the key points that make this book a must-read:

- Unveiling Money Myths: The book challenges conventional beliefs about the money system, revealing that money creation is largely controlled by private banking institutions.

- Understanding Debt Dynamics: It explains how banks create money as loans, but do not create enough to cover the interest, leading to an endless cycle of debt and inflation.

- Historical Perspectives: The author draws on historical examples from colonial America and insights from influential figures like Benjamin Franklin, Thomas Jefferson, and Abraham Lincoln.

- Financial Implications: Readers will learn how this money system diminishes the value of their money and impacts their financial security.

- Exploring Alternatives: The book proposes workable alternatives to the current system, encouraging readers to consider different approaches to economic stability.

- Empowerment Through Knowledge: By understanding the mechanics of the money system, readers can become more informed and empowered in their financial decisions.

Final Thoughts

“Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free” is a compelling exploration of the often misunderstood world of finance. This book unravels the myths surrounding our monetary system, revealing the unsettling truth about how money is created and controlled by private banking institutions. By exposing the pitfalls of our current financial system, the author invites readers to reconsider their understanding of money and its implications for personal and national financial security.

Here are some key takeaways from the book:

- Insight into the privatization of money creation and its impact on the economy.

- Understanding the cycle of debt and how it affects the value of your money.

- Historical perspectives from influential figures like Benjamin Franklin, Thomas Jefferson, and Abraham Lincoln.

- A practical alternative to the current system, based on proven economic principles.

This book is not just an eye-opener; it’s a call to action for anyone concerned about their financial future. Whether you’re a seasoned economist or a curious newcomer to the world of finance, “Web of Debt” provides valuable insights that are essential for navigating today’s economic landscape. It’s a worthy addition to any reader’s collection, sparking critical conversations about money and its impact on our lives.

Don’t miss out on the chance to empower yourself with knowledge. Purchase “Web of Debt” today and take the first step towards financial enlightenment!